News

Prof. Louis Cheng Gave a Presentation to the Student Delegate from American University of Sharjah, The United Arab Emirates (Jan 5, 2026)

On January 5, 2026, Prof. Narjess Boubakri, Dean of the School of Business Administration at the American University of Sharjah, United Arab Emirates (UAE), along with the Student Delegate, visited The Hang Seng University of Hong Kong.

During the visit, Prof. Louis Cheng delivered an insightful presentation on Fintech and ESG Integration, which was very well-received by the students. The session sparked engaging discussions on the intersection of financial technology and sustainable practices, highlighting the growing importance of ESG in shaping the future of finance.

Prof. Louis Cheng as a Visiting Professor at the Center for ESG Studies, Universitas Airlangga, Indonesia to Support ESG Research and ESG Engagement (Dec 15-19, 2025)

Prof. Louis Cheng was appointed as a Visiting Professor at Center for Environmental, Social, and Governance Studies (CESGS), Universitas Airlangga (UNAIR), Indonesia and paid a visit to Surabaya and Jakarta from December 15 to 19, 2025. Below is a summary of the events during the trip.

Event 1: Participate in the discussion with Prof. Iman Harymawan and his team on co-organizing the Asia Sustainable Business and Innovation Forum (ASBIF)

Date: December 15, 2025

Time: 9-10:30 AM

At the meeting, Prof. Cheng discussed operational strategies for HSUHK ESG Centre to co-organize the Asia Sustainable Business and Innovation Forum (ASBIF). The CESGS staff engaged in the discussion included Prof. Harymawan, Professor of Sustainability Accounting and Governance at UNAIR, Director of CESGS.

Event 2: Presentation at KAPM

Date: December 16, 2025

Time: 9-10 AM

Under the coordination of CESGS, Prof. Louis Cheng was invited to give a talk and provide some advice on ESG strategies for KAPM Railways Limited’s senior executives including the Vice President of Sustainability and Director of Operations of the Group.

Event 3: Presentation at Universitas Pertamina

Date: December 16, 2025

Time: 2-3 PM

Arranged by CESGS, Prof. Cheng visited Universitas Pertamina and gave a presentation titled “Sustainability Research and University Network”. The purpose of the visit is to explore possible cooperation and fundings of research projects from Pertamina Energy Group through Universitas Pertamina, which is a privately funded university by the energy group.

Various meetings are held with the university leaders including Vice Rector, senior advisors and the head of the centre for business sustainability.

Event 4: Participate in the discussion with Mr. Desmond Cheung at Indosat Ooredoo Hutchison

Date: December 17, 2025

Time: 12-1 PM

Coordinated by CESGS, Prof. Cheng visited Indosat Ooredoo Hutchison, a joint venture of Hutchison Telecom. Prof. Cheng also discussed with Mr. Desmond Cheung, Chief Technical Officer of Indosat on integrating ESG and AI initiatives for the company.

Event 5: Presentations at AJAR Workshop

Date: December 19, 2025

Time:

Part 1: Open Forum (9:20 -10:30 AM)

Part 2: Close Door Session (2:30 – 3:15 PM)

Prof. Cheng was invited to deliver presentations on sharing current research topics and research suggestions at the Asian Journal of Accounting Research (AJAR) Workshop.

(Part 1 of the Event)

(Part 2 of the Event)

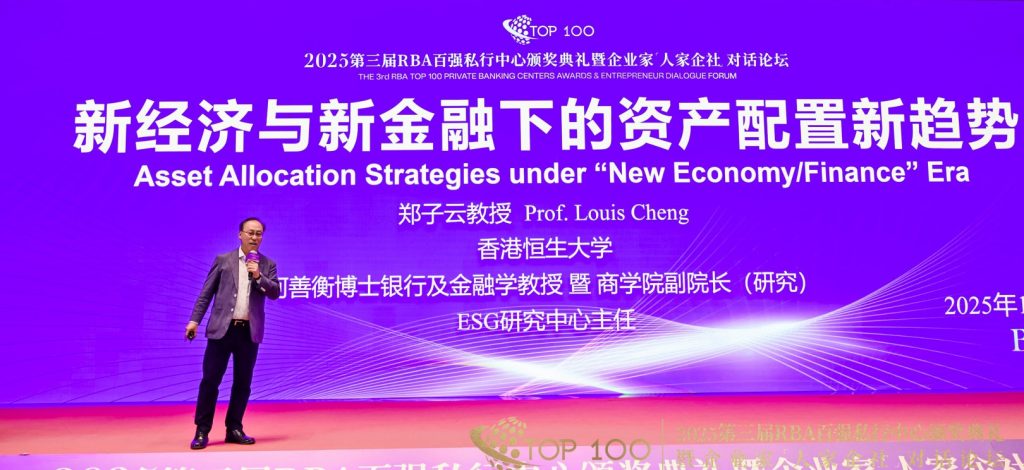

Prof. Louis Cheng Presented at the 3rd RBA Top 100 Private Banking Centers Awards 2025 & Entrepreneur Dialogue Forum, Shanghai (Nov 7, 2025)

On November 7, 2025, the 3rd RBA Top 100 Private Banking Centers Awards 2025 & Entrepreneur Dialogue Forum was held in Shanghai by the magazine Retail Banking.

Prof. Louis Cheng was invited to attend the event and gave a featured presentation titled “Asset Allocation Strategies under ‘New Economy/Finance’ Era”. The presentation was very well-received by the representatives from private banking practitioners at the event.

Media Coverage

– 2025第三届RBA百强私行中心颁奖典礼暨企业家“人家企社”对话论坛顺利召开

– 2025第三届RBA百强私行中心颁奖典礼暨企业家“人家企社”对话论坛顺利召开

Prof. Louis Cheng shared his view on ESG issues with MTR’s Environmental & Social Responsibility Committee (Oct 22, 2025)

On Oct 22, 2025, Prof. Louis Cheng was invited to share his view on the topic “Navigating ESG Trends Amid Global Political Uncertainty” with the Environmental & Social Responsibility Committee (E&SRC), which is a sub-committee of the Board of MTR Corporation. Participants included Dr Rex Auyeung Pak-kuen, GBS, JP, Chairman of MTR Corporation, board members of the committee and related senior executives of MTR.

Prof. Louis Cheng Presented at a Panel at the HKIB Annual Banking Conference 2025 (Sept 26, 2025)

The HKIB Annual Banking Conference 2025 was organized by The Hong Kong Institute of Bankers (HKIB) on Sept 26, 2025, at the Hong Kong Convention and Exhibition Centre.

Prof. Louis Cheng was invited to serve as a panelist on the panel “Transitioning with Nature – Innovative Products for a Sustainable Future”.

At the panel, Prof. Cheng shared his insights on the sustainable finance market in Hong Kong, how ESG indicators shape credit and investment strategies, long-term profitability, and How innovation in Fintech can accelerate the transition to sustainable finance, etc.

MI x HSUHK ESG Award 2025 Ceremony was Successfully Held (Sept 18, 2025)

Master Insight and Research Centre for ESG (CESG) at The Hang Seng University of Hong Kong (HSUHK) co-organized the 4th ESG Award. The award ceremony was successfully held on Sept 18, 2025, at Conrad, Admiralty.

Prof. Louis Cheng, the Chairman of the ESG Award Judging Panel, emphasized that the successful hosting of the ESG Award is the outcome of collective efforts from numerous organizations. These awards serve to recognize and honor the dedication and outstanding achievements of winning companies and institutions in the field of sustainable development.

Other members of the ESG Award Judging Panel include Dr. Eva CHAN, Chairman, Hong Kong Investor Relations Association, Prof. Yangyang CHEN, Head of Department of Accountancy, City University of Hong Kong, Prof. Darwin CHOI, Deputy Head and Associate Professor, Department of Finance, The Hong Kong University of Science and Technology, Prof. Albert IP, Senior Advisor to President & Chairman, HKUST Foundation, Mr. Scott LEE, Head of Strategic Partnerships, CFA Institute, Dr. Patrick POON, Foundation Chairman and Board of Governors at HSUHK, Board Chairman, Master Insight, Dr. Jacky TANG, Chief Investment Officer of an international investment bank and Adjunct Professor, HSUHK.

Click here to read more.

Prof. Louis Cheng was conferred an honorary member title and elected as a member of the Board of Directors of IFPHK (Sept 9, 2025)

Prof. Louis Cheng was conferred an honorary member title for his contribution for the past 20 years and he was successfully elected as a member of the Board of Directors for Institute of Financial Planners of Hong Kong (IFPHK).

Prof. Louis Cheng attended the event of Smart Money Challenge 2025 for Hong Kong Secondary Students & Legislative Council Experience Day (July 8, 2025)

The Hang Seng University of Hong Kong, in collaboration with the Youth Innovation Development Charity (YIDC) and the Youth Concentric Association, successfully hosted the Smart Money Challenge 2025 for Hong Kong Secondary Students cum Legislative Council Experience Day at the Legislative Council Complex on July 8, 2025.

Prof. Louis Cheng, as Acting Dean, delivered a closing remark for the event. He emphasized that the event effectively enhanced students’ comprehension of financial discipline and planning. Leveraging his expertise in financial education, he urged young individuals to take control of their financial futures. He also reaffirmed HSUHK’s dedication to promoting financial education in secondary schools through similar initiatives going forward. Both YIDC and the Youth Concentric Association committed to ongoing support for youth development, aiming to offer more educational and exchange opportunities for young people throughout Hong Kong.

Prof. Louis Cheng was Appointed as ESG Advisor for the Hong Kong Police Force (July 3, 2025)

Prof. Louis Cheng was appointed as ESG Advisor (Environmental & Social Domains) for three years for the Hong Kong Police Force at the ESG Thank You Reception at Police Headquarters on July 3, 2025.

At the headquarters, Prof. Cheng was given the Appreciation Certificate and the Appointment Certificate by Mr. Ronny Chan, Assistant Commissioner of Police (Personnel).

During the Reception, Prof. Cheng was asked to give comments on ESG development and directions for the Police Force.

Prof. Louis Cheng (left) was given the Appreciation Certificate and the Appointment Certificate by Mr. Ronny Chan (right)

Prof. Louis Cheng as the Chairman of HKIRA Investor Relations Awards Judging Panel (June 27, 2025)

As the Chairman of HKIRA Investor Relations Awards Judging Panel, Prof. Louis Cheng announced the winners of Grand ESG/IR Awards and shared his views at the 11th Hong Kong Investor Relations Awards (IR Awards) in 2025 for recognizing Hong Kong listed companies and IR professionals for their outstanding performance and best practices in investor relations.

Read more: https://www.hkira.com/en/events/files/awards250630_en.pdf

New “Sustainable Investing Certificate” (Formerly Certificate in ESG Investing) Program Discount (May 26, 2025)

The Research Centre for ESG (CESG) of the Hang Seng University of Hong Kong (HSUHK) is proud to collaborate with the CFA Institute to benefit our staff and students in pursuing ESG and climate finance knowledge. Sustainable Investing Certificate (formerly “Certificate in ESG Investing”) offers a 20% discount for a limited time (1st May – 31st July 2025) to HSU staff and students.

To know more, please visit the landing page.

HSU ESG Research Centre Successfully Held “ESG Intelligence: Theory and Practice” Conference to Unveil the Three-Year Research Outcomes

(May 19, 2025)

Funded by the IDS grant from the RGC, the Research Centre for ESG of The Hang Seng University of Hong Kong (HSUHK) successfully hosted its “ESG Intelligence: Theory and Practice” conference at Conrad hotel on May 19, 2025. The event drew over 70 financial leaders, policymakers, scholars, and sustainability experts to explore actionable strategies for environmental, social, and governance challenges. Professor Joshua Mok Ka-ho, Provost and Vice-President (Academic & Research) of HSUHK delivered a keynote address titled “Social Entrepreneurship: Policy and Practices in Hong Kong”, mapping the government’s strategic shift in social innovation.

Additionally, Professor Louis Cheng, Director of the Research Centre for ESG and Associate Dean (Research) of School of Business gave a featured presentation to summarized the research finding of the RGC project titled “Establishing a Research Infrastructure for ESG Intelligence: A Multi-Stakeholder Perspective” (RGC Ref. No.: UGC/IDS(R)14/21). The session highlighted four stakeholder perspectives on ESG data intelligence: investors, accounting, consumers, and corporate communications. Then, a panel of experts further elaborated the research insight and industry applications of the topics. To read the complete report of the IDS research, please visit the ESG Centre website at https://esg.hsu.edu.hk/ids-esg-report/.

During the conference, Ms. Vivi Hu, CEO of YoujiVest, demonstrated how AI is revolutionizing the business applications and investment strategies using big data related to climate change and ESG. Besides, a fireside chat moderated by Prof. Louis Cheng featuring Dr. Jacky Tang, Chief Investment Officer of an international asset management firm, and Dr. Ricky Szeto of Social Welfare Advisory Committee tackled the issue of balancing between financial return and societal impact. Participants and speakers engaged in an active dialogue throughout the conference.

Detachment Announcement from ASERCC

This is to announce that the Research Centre for ESG (CESG) at HSUHK is no longer affiliated with Asia Sustainability and ESG Research Center Consortium (ASERCC). Any organization and personnel claiming to be associated with ASERCC have no connection or relationship with CESG. CESG and HSUHK are not responsible for any liability due to financial damages and legal liability directly or indirectly as a result of any parties collaborating with ASERCC.

Prof. Louis Cheng delivered a featured presentation at the Retail Banking Annual Conference 2025 and RBA 8th Retail Banking Awards Ceremony (April 9, 2025)

Prof. Louis Cheng delivered a featured presentation titled “The New Era of AI — Insights into ESG Investment and Green Finance” at the Retail Banking Annual Conference 2025 and RBA 8th Retail Banking Awards Ceremony in Hangzhou on April 9, 2025.

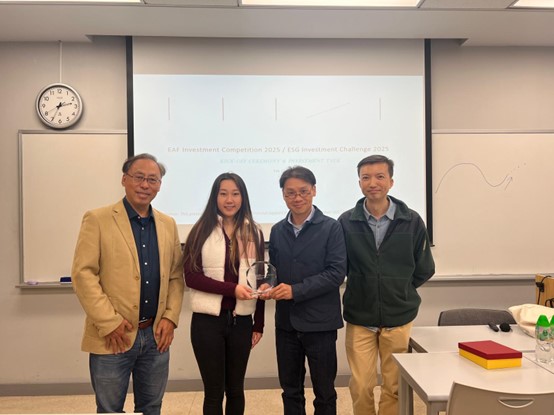

Highlights from the ESG Investment Challenge 2025 Ceremony: Insights from Prof. Louis Cheng and Ms. Angela Zhao at the EAF Investment Talk (Mar 6, 2025)

The much-anticipated annual EAF Investment Competition 2025 was officially kicked off on 6 March 2025. This year we launched a new competition in addition to the original investment competition – the ESG Investment Challenge 2025 which aims to educate participants on sustainable investing by incorporating Environmental, Social, and Governance (ESG) factors into stock selection and trading strategies. Both competitions will run from 3 March 2025 to 20 June 2025. There are more than 70 undergraduate participants from the School of Business this year. They are grouped in teams to compete in a renowned trading simulation platform using real time data and news. After the opening remark, we presented the certificates to the winning teams and awardees of last year’s competition. This was followed by a talk given by our guest Ms. Angela Zhao, an experienced research analyst specialising in investor communications in ESG & climate reporting for macro hedge funds. Prof Louis Cheng served as the moderator. The Investment Talk featured insights into the latest developments in ESG investing. Both Angela and Prof Cheng shared their experience and techniques for selecting ESG-related stocks, and the practical knowledge in this field. All participants are excited to have gained expert knowledge and industry insight.

Please click here to read the full article.

ESG in Focus: HSU-SYU Seminar – ESG x Internationalization was Successfully Held (Feb 17, 2025)

The Research Centre for ESG organized an ESG seminar at HSU campus on Feb 17, 2025, attracting about 30 academics from multiple universities and colleges to join.

At the seminar, Mr. Chanyoo Kim, ESG Client Engagement Senior Specialist from S&P Global, introduced S&P Global ESG Scores and interacted with the audience actively, sharing sustainability development from an industrial perspective.

In the next session, Prof. John Goodell, Editor in Chief, Research in International Business and Finance, (RIBAF), Professor in Finance, University of Akron, USA, had a research dialogue with the moderator, Prof. Louis Cheng, going through the suggested topics of the RIBAF Special Issue: Business Sustainability and ESG Integration: An International Business Perspective. The Guest Editors of the Special Issue, Prof. Ricky Chan and Prof. Walid Saffar, also engaged in the conversation. The insightful sharing was well-received by the audience.

Prof. Louis Cheng, Director of CESG at HSUHK Shares Strategies for Stable Investment Returns at the Investor Relations Annual Symposium 2024 (Dec 16, 2024)

Prof. Louis Cheng, Director of CESG at HSUHK at Hang Seng University, attended the 2024 Investor Relations Annual Conference organized by the Hong Kong Investor Relations Association (HKIRA), where he delivered an engaging presentation titled “Generating Stable Investment Returns During Volatile Market Conditions.”

During his speech, Prof. Cheng provided an in-depth analysis from three perspectives: past, present, and future, with particular emphasis on current and future investment trends that captured the audience’s attention. He introduced the i-Score, a rating system that provides ESG information for the top 500 listed companies in Hong Kong and integrates ESG scores. Additionally, Prof. Cheng highlighted that, according to assessments by YoujiVest, the ESG i-Score outperformed the Hang Seng ESG Enhanced Index (HSEEI) in reflecting negative ESG sentiment in 2023, underscoring the significance of ESG indicators in investment decision-making.

Addressing the audience’s concerns regarding future investment portfolios, Professor Cheng introduced the concept of Sustainable High-Yield Portfolios (SHY). He emphasized that the key to establishing such portfolios lies in ensuring stable income or cash flow to support high dividend generation. Furthermore, he noted the importance of analyzing dividend yields and returns during both volatile and normal market periods. Prof. Cheng also pointed out that incorporating ESG into investment strategies can serve as an essential tool for risk mitigation.

In addition, Prof. Cheng presented certificates to 17 listed companies that participated in the Investor Relations Pledge Program, recognizing their efforts and achievements in enhancing investor relations. This symposium not only provided valuable insights for investors but also fostered in-depth discussions within the industry regarding ESG investments.

恒生大學ESG研究中心主任鄭子云教授在2024年投資者關係研討會分享「穩定投資回報策略」

恒生大學ESG研究中心主任鄭子云教授出席由香港投資者關係協會舉辦的2024年投資者關係年度研討會,並為與會投資者帶來了一場題為《在波動市場條件下產生穩定投資回報》的精彩演講。

在演講中,鄭子云教授從過去、現在和未來三個角度進行了深入分析,特別引起現場觀眾關注的是當前及未來的投資趨勢。他介紹了i-Score,這是一個為香港500強上市公司提供ESG信息的評分系統,並進行了ESG分數的整合。另外,鄭教授指出,根據YoujiVest的評估,i-Score在反映ESG負面情緒方面的表現均優於2023年的恒指ESG增強指數,這顯示出ESG指標在投資決策中的重要性。

針對投資者和現場觀眾關心的未來投資組合,鄭子云教授介紹了可持續高收益投資組合(SHY)的概念。他強調,建立可持續高收益投資組合的關鍵在於確保穩定的收入或現金流,以支持高股息的產生;同時,在市場波動或正常期間進行股息率和回報的分析至關重要。此外,鄭教授指出,將ESG納入投資策略可以作為降低風險的重要工具。

另外,鄭子云教授還為17家獲得投資者關係承諾計劃的上市公司頒發了證書,表彰它們在提升投資者關係方面的努力與成就。此次研討會不僅為投資者提供了寶貴的見解,還促進了業界對ESG投資的深入討論。

2nd Asia Sustainability and ESG Summit 2024 was Successfully Held in Bali

(Dec 6, 2024)

The 2nd Asia Sustainability and ESG Summit 2024 was successfully held on December 5-6 at The Kuta Beach Heritage Hotel Bali in Indonesia. 3 Best Papers Awards and 2 Emerging Scholar Awards were given and over 60 papers from 12 countries and regions were presented at the Summit. Participants from 48 universities joined in this engaging event. The Summit brought together academics, PhD students, industry executives, government officials and NGO professionals to learn about the latest ESG developments.

Please stay tuned for more information about the arrangements for the next ESG Summit. We hope to see you at the next Summit!

Bali Summit Video

Best Paper and Emerging Scholar Awardees

Click here to see.

Highlights of the Summit

Photo Gallery

Introduction Video of 2nd Asia Sustainability and ESG Summit 2024 in Bali

(Dec 5, 2024)

Joint Announcement: CFA Institute and Research Centre for ESG Launch the CFA ESG Certificate Discount Program for HSUHK (Nov 27, 2024)

On November 27, 2024, the Research Centre for ESG (CESG) of the Hang Seng University of Hong Kong (HSUHK) announced a collaboration with CFA Institute which benefits its staff and students in their pursuit of ESG and climate finance knowledge. On January 27, 2025, Scott Lee, Senior Director, Strategic Partnerships at CFA Institute visited CESG at HSUHK and discussed with Prof. Louis Cheng on ways to promote this discount program.

“The Hang Seng University of Hong Kong stands as a vital pillar in nurturing talent for the finance industry in the region. We are thrilled to collaborate with Prof. Louis Cheng to launch this exciting partnership, which extends special learning offer from the CFA Institute to all Hang Seng University students. This initiative presents a fantastic opportunity to promote industry knowledge and cultivate a robust talent pool for Hong Kong’s future workforce,” expressed Scott Lee.

In fact, the CFA ESG certificates are valuable to our colleagues in several ways. Below we have quoted two testimonies from HSUHK’s affiliated members:

Since the initial launch, additional certificates are added to the discount program. Currently, In addition, the 1) Climate Risk, Valuation, and Investing Certificate; 2) Private Markets and Alternative Investments Certificate; and 3) Private Equity Certificate are offered at a 20% discounted price for registration. For more information, please visit landing page for HSUHK.

Prof. Louis Cheng as a Speaker at the Top 100 Private Banking Centers Award 2024 & The Private Banking Summit, Shanghai (Nov 22, 2024)

On November 22, the Top 100 Private Banking Centers Award 2024 & The Private Banking Summit was held in Shanghai by the magazine Retail Banking.

Prof. Louis Cheng attended the event and gave a talk titled “Sustainable Investment Management: Enhancing Alpha through ESG Integration”. The presentation was very well-received by the representatives from private banking practitioners at the Summit.

Call for Paper: Special Issue at Journal of Asian Public Policy (JAPP)

(October 2024)

Topic: Business Sustainability and ESG Development: Asian Policy Perspectives

Recently, applying ESG to enhance business sustainability has become an important objective for corporations. While ESG integration is often an issue driven by business’ own initiatives, ESG disclosure can be more related to regulations and policy. As ESG integration and disclosure are popular research topics, it is time to explore their policy implications in the Asian context.

Guest Editor: Louis T.W. Cheng, Dr S H Ho Professor of Banking and Finance, The Hang Seng University of Hong Kong

This SI welcomes research related to the following topics applied to a specific industry sector, the financial sector or all non-financial sectors in Asia:

● Policy outcome evaluations relating green/environmental regulations to business sustainability

● Policy outcome evaluations relating ESG disclosure regulations to business sustainability

● ESG performance and related financial performance as a result of national policies

● Policy implications for establishing an ESG framework for listed firms

● Policy implications for establishing an ESG framework for non-listed firms

● Financial policies and their effects on enhancing ESG integration

● Outcomes of green financing policies

● Outcomes of policy and incentive scheme related to ESG/green capacity building, infrastructure, and nurturing talents

● Any research issues demonstrating a significant relationship between ESG regulations and business sustainability

Manuscript Submission Information:

All papers submitted to the SI for consideration should send their papers directly to the SI editor through the online submission HERE. All submitted papers will pre-viewed by the SI Guest Editor and accepted papers will go through the peer-reviewed process*. Please ensure you read the Guide for Authors before submitting your manuscript. Accepted manuscripts are expected to be published in a single SI in third quarter of 2025. Should you have any inquiries, please contact: rib.support@hsu.edu.hk

Keywords:

Asian Policy; ESG; Green; Business Sustainability

*The Editor-in-Chief of JAPP reserves the right for the final publication decisions of the SI.

Click here for the E-flyer

HSUHK ESG Research Centre unveils final report on Innovation and Technology Fund series activities: Explores the application of AI in evaluating corporate ESG performance (Sept 13, 2024)

Since its establishment in 2022, the Research Centre for ESG (CESG) at the Hang Seng University of Hong Kong has been dedicated to integrating ESG with innovation and technology. In alignment with this significant trend, CESG has successfully concluded the ITF (Innovation and Technology Fund) series of events, comprising two seminars and two symposiums, under the funding support (grant number: GSP/033/22) by ITC (Innovation and Technology Commissions) and in-kind sponsorships by Master Insight and Excellent Global Business Center. The events attracted many ESG experts and scholars to engage in an in-depth discussion on the integration of AI (artificial intelligence) into the assessment of a company’s ESG (Environmental, Social and Governance) performance. The final report of the ITF events is now released.

The report shows that the ESGi-Composite Scorecard devised by Prof Louis Cheng, the Director of the Research Centre for ESG, is an important AI tool in this project. It can be employed, for instance, to analyse media and social listening. In addition, it describes the methodology employed in its computation and an exposition of the enhancements made to different versions of the Scorecard. The Scorecard was developed to demonstrate the value and importance of a more dynamic ESG performance measure at the firm level.

The report also presents numerous visualisations, including a number of 3D graphs, of data extracted from the i-Composite Scorecard, including i-Score performance of Hong Kong listed companies, RavenPack sentiment score based on different keywords, and YoujiVest positive or negative ESG sentiment score, discussing the relationship among the sentiment data and the i-Score.

The events aim to promote technology-driven ESG sentiment indicators and facilitate corporate sustainable development through big data analysis. The final report is now available online, and the public can view and download it from the project’s website (https://www.bigdata-esg.com/).

For more details about the project, please visit: https://www.bigdata-esg.com/.

Please visit https://www.bigdata-esg.com/project-presentation to view or download the final report and the relative presentation materials.

To learn more about the proprietary i-Composite Scorecard, please visit https://www.bigdata-esg.com/the-top-500.

Disclaimer: Any opinions, findings, conclusions or recommendations expressed in this material/event (or by members of the project team) do not reflect the views of the Government of the Hong Kong Special Administrative Region, the Innovation and Technology Commission or the Vetting Committee of the General Support Programme of the Innovation and Technology Fund.

Media coverage:

香港恒生大學ESG研究中心(CESG)自2022年成立以來,致力於將ESG與創新科技相結合,在這一大趨勢下,ESG研究中心獲創新科技署的資助(項目編號:GSP/033/22)及灼見名家和卓越環球商務中心的實物贊助,成功舉辦了一系列關於創新及科技基金的活動。這一系列活動包括兩場研討會及兩場座談會,吸引眾多ESG專家學者參與其中,並就AI在企業ESG(環境、社會及管治)績效評估中展開深入討論。目前,有關系列活動的最終報告已發佈。

報告顯示,由恒大ESG研究中心主任鄭子云教授創建的ESGi-綜合計分卡(ESGi-Composite Scorecard)作為是次研究中的重要AI工具,例如,可通過該工具勘察媒體和對社會聆聽進行分析。另外,報告闡述了計分的方法及不同版本計分卡的改進之處,旨在展示公司層級更動態的ESG績效衡量標準的價值和重要性。

報告還展示了眾多可視化的數據,包含大量3D圖,展示從i-Composite Scorecard中提取的數據,包括香港上市公司的i-Score表現、RavenPack根據不同關鍵詞得出的情感分數,以及YoujiVest的ESG情感分數,並深入討論這些情感數據與i-Score之間的關係。

這系列活動旨在推廣技術驅動的ESG情緒指標,並通過大數據分析促進企業的可持續發展。最終報告現已上線,公眾可於資助計劃的網站(https://www.bigdata-esg.com/)查看和下載。

如欲了解計劃的更多詳情,請參閱網站:https://www.bigdata-esg.com/。最終報告及相關簡報資料可於https://www.bigdata-esg.com/project-presentation查看或下載。如需進一步了解獨特的ESGi-綜合計分卡,請訪問https://www.bigdata-esg.com/the-top-500。

免責聲明:在本刊物/活動內(或由項目小組成員)表達的任何意見、研究成果、結論或建議,並不代表香港特別行政區政府、創新科技署或創新及科技基金一般支援計劃評審委員會的觀點。

ESG Symposium was Successfully Held (Aug 6, 2024)

The Research Centre for ESG (CESG) organized an ESG symposium entitled “Understanding the measurements and performance of ESG integration” on Aug 6, 2024 at the HSUHK campus under the IDS project (UGC/IDS(R)14/21). 55 participants, including academics, industry executives, and civil servants attended the symposium.

Prof. John Goodell, Editor in Chief, Research in International Business and Finance (RIBAF), and Professor in Finance, University of Akron, USA, gave an impressive keynote speech on the title “Is ESG non-pecuniary? Reacting to the lawsuit of 25 attorneys general” and provided valuable insight in publishing ESG research in Q1 journals such as RIBAF.

Next, Prof. Louis Cheng hosted a fireside chat for Prof. Piyush Sharma, John Curtin Distinguished Professor and Professor of Marketing, Curtin University, Australia and Dr. Peiyuan Guo, Chairman of SynTao Green Finance. After Prof. Cheng introduced what is i-score and how to use i-score to measure ESG performance, the two speakers shared their views on integrating ESG Data into business research.

As for the next panel discussion, the moderator, Dr. Jerry Cao, Associate Professor of Finance, HSUHK, interacted proactively with representatives from well-known ESG data vendors. Ms. Liz Campbell, Client Relations, APAC, Morningstar Sustainalytics, Ms. Vivi Hu, CEO, YoujiVest, and Dr. Peiyuan Guo served as the panelists to report the latest development in ESG and climate data from the perspective of data providers and rating agencies.

Finally, academics were invited to participate in a roundtable discussion to share their questions and thoughts with Prof. John Goodell, Prof. Piyush Sharma, Dr. Peiyuan Guo, and Ms. Vivi Hu about their ESG research. The session provided valuable feedback for ESG researchers to improve their papers for possible publication.

MI x HSU ESG Award 2024 Ceremony was Successfully Held (July 29, 2024)

Master Insight and Research Centre for ESG (CESG) co-organized the 3rd ESG Award. The award ceremony was successfully held on July 29, 2024.

Media coverage:

Prof. Louis Cheng Moderated and Presented at a Panel at Bamboo and Sustainability Forum 2024 (May 22, 2024)

Prof. Louis Cheng was invited to serve as a panel moderator and share his insights in the session “Education Reimagined” for the Bamboo and Sustainability Forum 2024 on May 22, 2024. The Forum was co-organized by HSUHK and the Federation of Hong Kong Industries (FHKI), aiming to gather academic and industrial professionals together to share knowledge and experience in the latest bamboo development and applications.

During the panel discussion, Prof. Cheng shared the concepts of ESG and elaborated on the double impact of the corporations’ good ESG performance to simultaneously attract investors and shape employees’ green consumption behaviors. The presentation was well received by the audience.

Click here to read the related post.

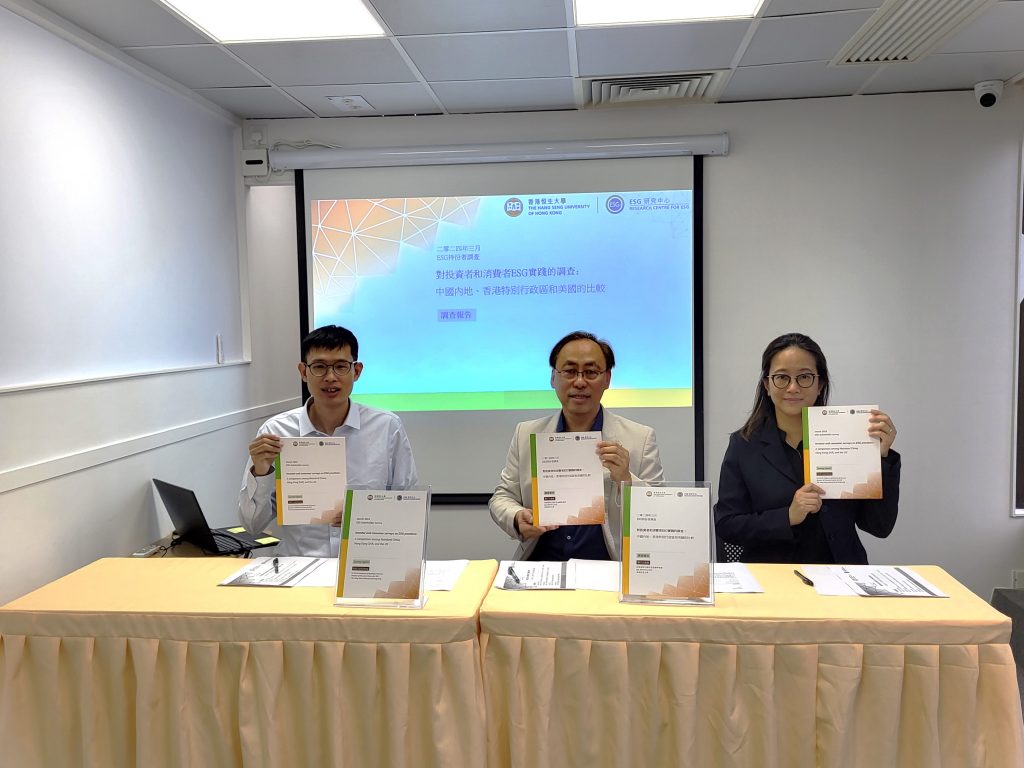

HSUHK ESG Centre Officially Launched the ESG Stakeholder Survey Report: Excellent ESG Performance for Corporations Can Lead to Win-Win (Apr 29, 2024)

HSUHK ESG Centre Officially Launched the ESG Stakeholder Survey Report. In recent years, SDGs and ESG have become global trends and gradually exerted profound impacts on Hong Kong. Funded by the UGC IDS research scheme, Prof. Louis Cheng, Dr S H Ho Professor of Banking and Finance and Director of the Research Centre for ESG, The Hang Seng University of Hong Kong, conducted two surveys under the project titled “Establishing a Research Infrastructure for ESG Intelligence: A Multi-Stakeholder Perspective” (RGC Ref. No.: UGC/IDS(R)14/21)”. In this report “Investor and consumer surveys on ESG practices: A comparison among Mainland China, Hong Kong SAR, and the US” published in April 2024, the research team explore two stakeholder perspectives, namely, 1) investors and 2) consumers/employees respectively. The survey results provide some interesting insights into the role of corporations and how their ESG efforts and performance are assessed and evaluated by these stakeholders.

For the investor survey (Survey 1), the research team engaged market research firms to conduct online surveys in the US and Mainland China respectively in November 2023, with 291 valid responses received in the US and 300 in Mainland China. The survey findings revealed that stocks’ ESG performance affects investors’ valuation. Investors bid higher for good ESG performance stocks, indicating their willingness to accept lower returns from high ESG stocks relative to low ESG stocks. Dr. King King Li, Associate Professor, Shenzhen Audencia Financial Technology Institute, Shenzhen University highlighted that “Investors from both Mainland China and the US care about ESG performance by sacrificing returns in pursuing various ESG issues. However, Mainland China investors are willing to sacrifice more returns to pursue ESG excellence relative to the US investors.”

For the consumer/employee survey (Survey 2), the research team engaged a market research firm to conduct surveys in October 2023, with 315 valid responses from the US and 317 from Hong Kong SAR. The consumer/employee survey found out that employees’ perception of their companies’ ESG/CSR performance would eventually enhance their green purchase behaviors as individual customers. In addition, employees/consumers in Hong Kong SAR exhibit a stronger preference for green purchase behaviors than those in the US. Dr. Liane Lee, Assistant Professor, Department of Marketing, The Hang Seng University of Hong Kong concluded that “Based on additional research analysis which is not demonstrated in the report, it can be drawn that the positive relationship is stronger between companies’ CSR performance and green purchase behaviors of their employee-consumers when the corporate value is more synchronized with the green value of the employees.”

Prof. Louis Cheng, Dr S H Ho Professor of Banking and Finance and Director of the Research Centre for ESG, The Hang Seng University of Hong Kong concluded that “More importantly, we see a strong connection between the findings of the two surveys. The common element for the two surveys is the value of ESG performance of corporations. A company with good ESG performance can simultaneously attract investors and shape employees’ green consumption behaviors. Such a double impact of attracting investors and improving ESG impacts on society through employees appears to be stronger in Hong Kong SAR and Mainland China than in the US. In short, corporations can create a win-win situation for their investors and employees in making real impacts on society.”

Media coverage:

星島頭條:恒生大學:內地投資者願犧牲回報 追求較佳ESG股份

灼見名家:香港恒生大學ESG研究中心發布調查報告 企業ESG表現為社會創造雙贏

香港財經時報:恒生大學ESG調查:內地投資者願意犧牲更多回報追求卓越ESG表現

AAStocks:恒生大學調查:投資者願意投資高評級 ESG 股票

Yahoo財經:恒生大學調查:投資者願意投資高評級 ESG 股票

香港恒生大學 ESG 研究中心 ESG 持份者調查報告指出投資者願意投資高評級ESG 股票

HSUHK ESG Stakeholder Survey Report finds stocks with good ESG performance attract more investors

Click here to read the media coverage file prepared by SPRG.

香港恒生大學ESG研究中心發佈ESG持份者調查報告。近年來,可持續發展目標(SDGs)及環境、社會和管治(ESG)已成為全球趨勢,並對香港的影響逐步加深。香港恒生大學何善衡博士銀行及金融學教授暨ESG研究中心主任鄭子云教授(Prof. Louis Cheng)在教資會院校發展計劃(IDS)贊助下,進行研究項目“組建‘環境、社會、管治’情報的研究基建平台:持份者角度”(研究資助局項目編號:UGC/IDS(R)14/21),並於2024年4月發佈報告“對投資者和消費者ESG實踐的調查:中國內地、香港特別行政區和美國的比較”。報告中的兩項調查旨在了解兩個特定的ESG持份者群體,即1) 投資者和2) 消費者/員工。調查結果為企業的角色以及這些持份者如何評估企業的ESG投入和表現提供了一些有趣的見解。

在投資者調查(調查一)中,研究團隊聘請市場調查公司於2023年11月分別對美國及中國內地的投資者以線上形式進行調查,各收到291和300份有效回覆。調查結果顯示,ESG影響投資者對股票的估值,投資者對ESG表現良好的股票的出價更高,這表明,即使高評級ESG股票的收益低於低評級ESG股票,投資者仍願意投資高評級ESG股票。李景景博士, 深圳大學深圳南特金融科技學院副教授指出:「中國內地和美國投資者對ESG方面的關注不同,都願意以犧牲股票收益的方式來追求更好的ESG表現。然而,與美國的樣本相比,中國內地的投資者願意犧牲更多回報來追求卓越的ESG表現。」

在消費者/員工調查(調查二)中,研究團隊聘請市場調查公司於2023年10月分別在美國和香港特區進行調查,收到來自美國受訪者的315份有效回覆,及香港特區受訪者的317份有效回覆。由該調查可知,員工對公司企業社會責任表現的認知最終會加強他們作為個人消費者的綠色購物行為。香港特區的員工-消費者比美國的員工-消費者更傾向實踐綠色購物行為。李暐英博士, 香港恒生大學市場學系助理教授得出結論:「根據報告中未披露的其他研究分析,可得出結論,如果企業價值與員工的綠色價值觀更加同步,那麼公司的企業社會責任表現與其員工-消費者的綠色購物行為之間的正相關關係就會更強。」

香港恒生大學何善衡博士銀行及金融學教授暨ESG研究中心主任鄭子云教授(Prof. Louis Cheng)總結:「通過進一步分析,報告揭示兩項調查結果之間存在密切關聯。這兩項調查都體現了企業ESG表現的重要價值。ESG表現良好的企業可以在吸引投資者的同時塑造員工的綠色消費行為,由此創造企業和社會的雙贏局面。這種既能夠吸引投資者,又能通過員工促進ESG對社會的影響的雙重效益在香港特區和中國內地比在美國更顯著。簡而言之,企業可以通過自身的ESG表現為自己的投資者和員工創造雙贏局面,從而對社會產生真正的影響。」

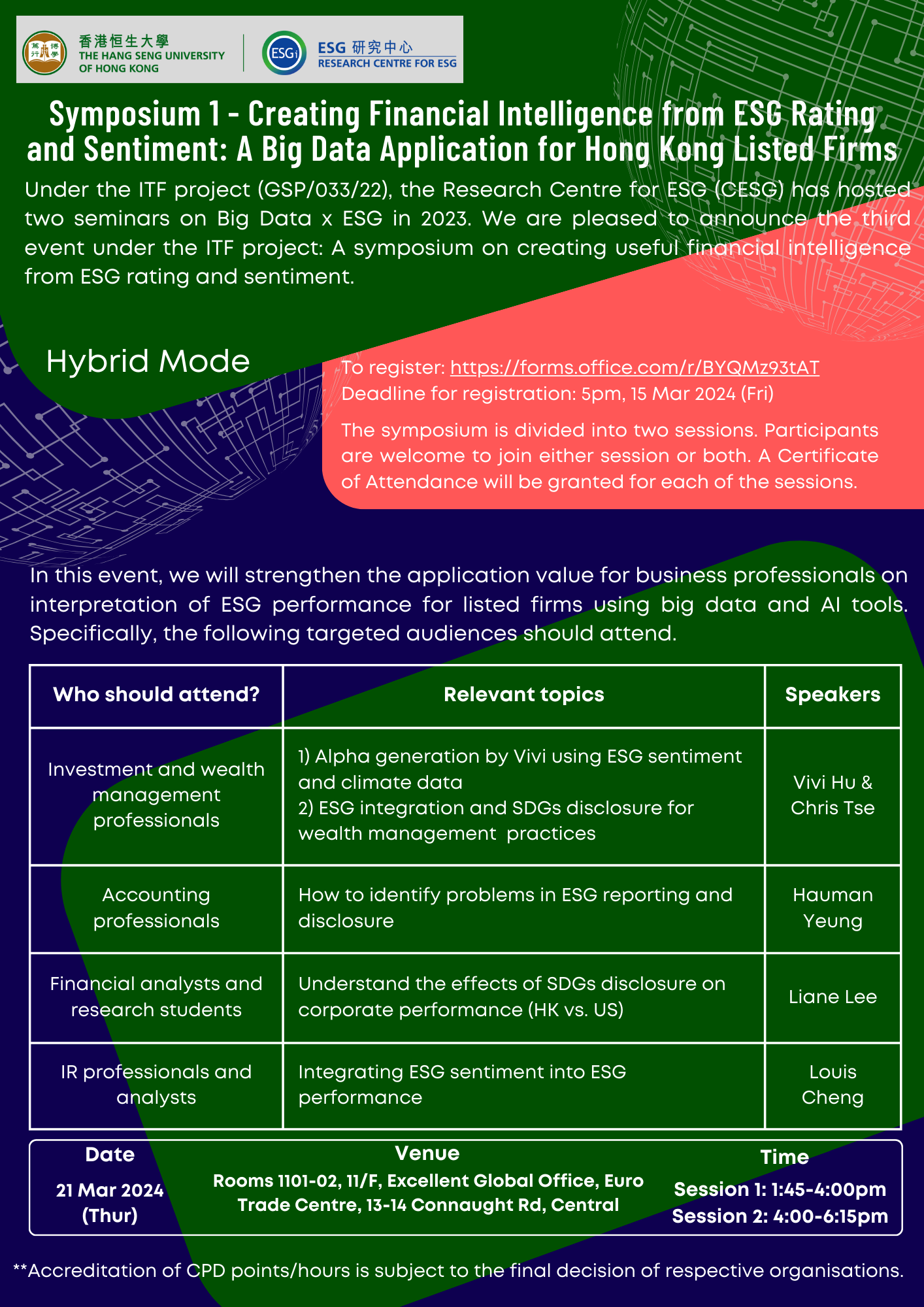

The Research Centre for ESG (CESG) organizes a Fintech x ESG Symposium on March 21, 2024

Symposium Topic: Creating Financial Intelligence from ESG Rating and Sentiment: A Big Data Application for Hong Kong Listed Firms (March 21, 2024)

是次研討會得到創新及科技基金計劃的支持。活動將展示如何使用恒大ESG研究中心獨有的ESG 表現衡量標準做出一些商業決策,亦會公布i-Composite Scorecard 500強企業的完整名單。

香港恒生大學ESG研究中心(CESG)將於3月21日(星期四)在中環舉辦有關ESG評級及情緒指數的研討會。研討會着眼於利用大數據和人工智慧來分析上市公司的ESG(環境、社會與管治)表現。

恒大ESG研究中心在創新及科技基金計劃的支持下,成功在2023年舉辦了兩場研討會,探討如何將大數據及人工智慧應用於ESG中。是次研討會得到創新及科技基金計劃的支持。活動將展示如何使用恒大ESG研究中心獨有的ESG 表現衡量標準做出一些商業決策,亦會公布i-Composite Scorecard 500強企業的完整名單。研討會分為上下兩場,歡迎資訊科技(IT)相關專業人士、政府機構、學者和各學科的學生參與其中一場或整場活動,以下為活動詳情:

主題:從ESG評級和情緒解讀金融情報:大數據應用於香港上市公司

日期:2024年3月21日(星期四)

時間:下午1時45分至6時15分(上半場:下午1時45分至4時正;下半場:下午4時正至6時15分)

地點:中環干諾道中13-14號歐陸貿易中心11樓1101-02室卓越環球商務中心

報名連結:https://forms.office.com/r/BYQMz93tAT

報名截止日期:2024年3月15日下午5時正

由於場地名額有限,報名將以先到先得的方式進行。如果實體場地人數已滿,大會可能選擇更大的場地或從實體參與轉換成線上參與。

有關研討會或此計劃的詳情,可參閱https://www.bigdata-esg.com/。如有任何疑問,請電郵esgevents@hsu.edu.hk。

ESG Seminar: Expanding your career choices through ESG knowledge was successfully held (Feb 27, 2024)

The Research Centre for ESG (CESG) organized an ESG seminar at HSU campus on Feb 27, 2024, attracting more than 50 students to join.

Prof. Louis Cheng served as the main speaker of the seminar and shared views on how to integrate ESG knowledge into skillsets so that the students can be better prepared for future employment and career development. The guest of the seminar, Mr. Cyrus Cheung, Partner for ESG service in PwC also gave a presentation on the role as an ESG consultant and why ESG is so important in both public and private practice. Also, students were encouraged to take the opportunity to raise questions to the speakers.

Download the PPT here.

Prof. Iman Harymawan Visited HSU and Talked to Our Colleagues (Jan 10, 2024)

Prof. Iman Harymawan, Professor of Accounting, Director of Airlangga Global Engagement, Universitas Airlangga, visited the HSU campus and met with SBUS colleagues on Jan 10, 2024.

Hosted by Prof. Louis Cheng, the meeting explored the possibility of co-organizing the second Asia Sustainability and ESG Summit in Bali, Indonesia. In addition, further research collaboration is expected in order to strengthen the partnership between CESG, HSUHK, and Center for Environmental, Social, & Governance Studies (CESGS), UNAIR.

The preliminary conclusion is that HSU and UNAIR will co-host the 2nd ESG Summit in Bali at the end of this year or the beginning of next year. Also, UNAIR will explore sending some graduate students to HSU to conduct ESG research this summer.

Sustainability Leadership Symposium was Successfully Held (Jan 9, 2024)

English version:

Prof Simon S.M. Ho, President of HSUHK, developed a stakeholder-based “Responsible Management” conceptual framework which focuses on three fundamental components, namely Stakeholders, Ethics and Sustainable Values.

Led by Prof. Louis Cheng, The Research Centre for ESG (CESG) of The Hang Seng University of Hong Kong (HSUHK) held the Sustainability Leadership Symposium to discuss how sustainability leadership is being practiced in the business world with a focus on stakeholders’ perspective on Jan 9, 2024, in Central, bringing around 70 academic and industry professionals to attend the morning forum.

In addition to the keynote speech by the President on the topic “The Objective of a Corporation: Optimising Sustainable Values for Different Stakeholders”, two discussion panels on ESG Leadership, one on financial services and the other on NGOs were arranged. Many participants including academics from other universities and industry leaders actively engaged in discussions with the speakers. The overall evaluation from the participants is very satisfactory, achieving an evaluation rating of about 9 points out of 10.

For the afternoon closed-door Roundtable, senior representatives from ten organisations including Securities and Futures Commission, Hong Kong Institute of Certified Public Accountants, Hong Kong Chartered Governance Institute, CFA Society Hong Kong, The Hong Kong Institute of Bankers, Hong Kong Securities and Investment Institute, UN ESCAP Sustainable Business Network and others joined the meeting to discuss the role of stakeholders in ESG practice in Hong Kong.

After Prof. Ho introduced the background and discussion items of the meeting, the participants exchanged their opinions proactively. The meeting lasted for over two hours with active discussion on the topic. Key conclusions can be summarized as below:

● The participants recognized that investors are the single major stakeholder in the Hong Kong market among all stakeholders. ESG has been taken seriously since the HKEx mandated companies to disclose and it is established mainly from the perspective and needs of investors. Additionally, the purpose of being a listed company is to raise funds from investors. Investors will remain the primary focus of ESG reporting.

● It is important to consider a multi-stakeholder perspective in ESG reporting, but it should not be mandatory. Different stakeholders may have conflicting value perspectives. It would be difficult for the company to balance multi-stakeholders’ requests as there is no easy framework to solve the existing problems.

● It is agreed that ESG reporting is crucial for listed companies. Investors invest in the company’s future rather than past performance. While financial reports reveal the current performance of a company, ESG reports provide a forward-looking perspective on the company’s prospects.

● Education should play a more significant role in persuading the Board to pursue ESG cost-effectively with impacts. The Board holds a leadership role in ESG reporting since they determine the materiality assessment. It is important for the Board to identify and implement its ESG strategies and evaluate the information needs of multiple stakeholders.

中文版:

香港恒生大學校長何順文教授提出以持份者為基礎的「責任管理」(Responsible Management)概念框架,重點關注三個基本組成部分,即持份者、商業道德和可持續發展價值觀。

本次可持續發展領導表現座談會由恒大ESG研究中心鄭子云教授主持,於2024年1月9日在中環舉行,從持份者的角度探討商界如何實踐可持續發展領導表現,吸引了約70名學術界和業界人士參加座談會的晨間論壇。

除了何順文校長以「企業的目標:為不同持份者優化可持續價值觀」為主題的演講外,論壇還安排了兩場關於ESG領導表現的討論,一場從金融服務行業的視角出發,另一場從非政府組織的角度來探討。 來自其他大學的學者和行業領袖等眾多與會者積極與演講者進行討論。 參與者的整體評價非常令人滿意,達到了9分(滿分10分)左右的評價。

在下午的閉門圓桌會議上,來自證券及期貨事務監察委員會、香港會計師公會、香港公司治理公會、香港特許金融分析師協會、香港銀行學會、香港證券及投資學會、聯合國亞太經濟社會委員會可持續發展商業網絡等十家機構的高級代表出席並討論持份者在香港ESG實踐中的角色。

在兩個多小時的會議中,何教授介紹了會議背景和討論議題後,與會代表積極交流了各自觀點,主要結論可歸納如下:

● 與會代表一致同意,投資者是香港市場所有持份者中唯一的主要持份者。自港交所強制要求企業進行披露以來,主要從投資者的角度和需求出發而建立的ESG就倍受重視。 此外,上市公司的目的是向投資者籌集資金。 投資者仍將是 ESG 報告的主要關注點。

● 在ESG 報告中從多方持份者的視角出發很重要,但不應是強制性的。 不同的持份者可能有相互衝突的價值觀。 由於沒有簡單的框架來解決現有問題,企業很難平衡多方持份者的要求。

● ESG 報告對於上市公司至關重要。 投資人投資的是公司的未來而不是過去的表現。 財務報告揭示了公司目前的業績,而 ESG 報告則提供了公司前景的前瞻性視角。

● 教育界應提倡及加深董事會成員對ESG在公司角色的了解,同時增強追求具有成本效益且具影響力的ESG的教育。 董事會必須明白哪些是企業的顯著ESG 因素,從而確定並實施一個平衡多方持份者利益的綜合ESG策略。

Prof. Louis Cheng Gave a Presentation on Integrating ESG into Financial Planning Practices at the IFPHK Financial Planning Conference 2023 (Dec 19, 2023)

Prof. Louis Cheng gave a presentation on Integrating ESG into Financial Planning Practices at the IFPHK Financial Planning Conference 2023, Dec 19, 2023, at the Hong Kong Convention and Exhibition Centre. The event brought together over 300 leading experts, regulators, government officials and CFP® professionals.

Prof. Cheng’s presentation was well received and his vision on integrating ESG into financial planning is very much appreciated by the audience.

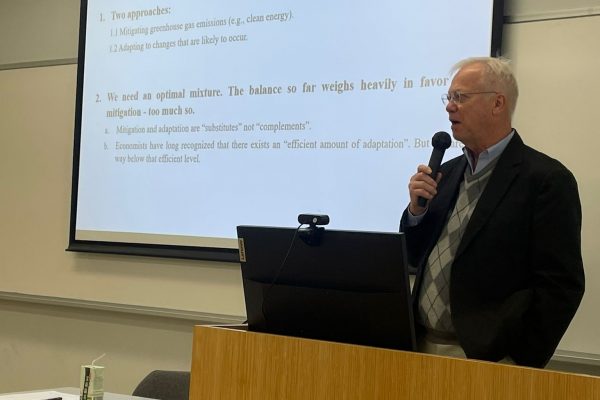

Prof. James Smith Visited Our ESG Centre to Deliver a Public Speech at HKIRA 15th Anniversary Summit and Talked to Our Colleagues (Dec 15, 2023)

On behalf of the Research Centre for ESG, HSUHK, Prof. James Smith, Professor Emeritus, Southern Methodist University and Past-President of IAEE, conducted a presentation on “Can we adapt to Climate Change? The Financial Challenge” at HKIRA 15th Anniversary Summit cum Cocktail Celebration on Dec 15, 2023. The Fire-side Chat was hosted by Prof. Louis Cheng.

On Dec 20, Prof. James Smith attended the roundtable meeting and talked to the School of Business faculty on the topic “Mitigation vs. Adaptation: Meeting the Challenge of Climate Change”, sharing his views on how the two approaches (mitigation and adaptation) can be optimally combined to realize an efficient amount of adaptation according to its cost-effectiveness.

For Prof. James Smith’s detailed discussion on climate change, please see the exclusive interview by Master Insight (灼見名家) here.

Prof. Louis Cheng Hosted a Fireside Chat with Prof. James Smith (Dec 15, 2023)

Prof. Louis Cheng hosted a Fire-side Chat with Prof. James Smith, Professor Emeritus, Southern Methodist University and Past-President of IAEE, on the topic “Can we adapt to Climate Change? The Financial Challenge” at HKIRA 15th Anniversary Summit cum Cocktail Celebration on Dec 15, 2023. The Fire-side Chat was sponsored by the ESG Centre and the event was attended by about 300 professionals from the IR industry, investment community, as well as C-levels and senior management representatives of listed companies. The event was held in a hybrid mode and more than 5200 attendees from mainland China and Hong Kong to join us online.

Prof. Louis Cheng Gave a Presentation at the Top 100 Private Banking Centers Award Ceremony & Shenzhen Bay Private Banking Forum 2023 (Nov 10, 2023)

On November 10, the Top 100 Private Banking Centers Award Ceremony & Shenzhen Bay Private Banking Forum 2023 was held in Shenzhen by the magazine Retail Banking.

Prof. Louis Cheng was invited to give a presentation titled “ESG Integration: From Optional to a Must”. After introducing the basic concepts of ESG integration, Prof. Louis explained “Why ESG integration has become a must in asset allocation” from the aspects of regional/ country regulations as well as business opportunities and clients’ demand. He also shared views on the future directions of ESG integration in China during the presentation.

Top 100 Private Banking Centers Award Ceremony 2023 & Shenzhen Bay Top 100 Private Bankers Summit (Nov 10, 2023)

Organizer: Retail Banking Magazine

Date: Nov 10 (Fri), 2023

Location: Shenzhen, China

Venue: Hotel Indigo Shenzhen Overseas Chinese Town

If you are interested in the summit, please click here for more information.

Prof. Louis Cheng will attend to give a presentation on ESG in asset allocation at the summit. The title of the presentation is: From Optional to Essential: The New Normal in Asset Allocation: Sustainable Investing (ESG).

In the past, ESG investment was not regarded as an important issue in asset allocation. But in recent years, China has proposed the target of Carbon Neutrality and the international market has emphasized more on ESG integration in asset allocation. Under this circumstance, Chinese financial banks need to address the practical way to launch ESG investment products to meet the requirements. Prof. Cheng’s presentation will focus on the transition stage and the suggestions for financial banks in Mainland.

Prof. Louis Cheng as the Speaker at SES 2023 International Symposium (Nov 3, 2023)

Prof. Louis Cheng was invited to share his insights at the SES (Social Enterprise Summit) 2023 International Symposium on November 3, 2023. Prof. Louis Cheng gave a presentation on “The Future of Impact Investing: Emerging Trends and Opportunities”. The presentation and the Q&A session were extremely well-received by over 100 representatives from social enterprises and corporations.

ESG Talk at Hong Kong Federation Youth Groups (Nov 1. 2023)

HKFYG invited Prof. Louis Cheng to give a talk on ESG integration for investment analysis and the latest global trend for investment products and services. The participants are mainly investment professionals and NGO leaders.

Prof. Louis Cheng was Invited to FPSB Global Meeting to Give a Presentation (Oct 18, 2023)

The highly anticipated 2023 FPSB Global Meeting took place in Singapore from 17 to 19 October 2023. The meeting gathered more than 70 delegates from 24 countries across the FPSB’s global network, where they discussed ways to strengthen, promote, and propel the financial planning profession.

On behalf of the IFPHK, Professor Louis Cheng, Director of the Research Centre for ESG of The Hang Seng University of Hong Kong delivered an engaging presentation together with Chris Tse on the topic “ESG and Financial Planning”. The global meeting was packed with a lot of useful insight and sparked meaningful discussions among the diverse group of attendees.

Prof. Louis Cheng Moderated a Panel on ESG Integration at Pension Bridge Alternatives APAC Hong Kong (Sept 26, 2023)

At the panel “Meeting Ambitious ESG Goals Whilst Ensuring Strong Returns”, Prof. Louis Cheng served as the moderator and commented that Dual Materiality (i.e., real impact and financial impact) has become more mainstream in Asia. In addition, he provided his views on opportunities for low-carbon investment products and seeking alphas in ESG integration in Asia. The two panellists are Dr. Roman Novozhilov, Head of ESG, New Development Bank, and Son Nguyen, Managing Partner, AQUIS Capital AG. After the panel, many investment professionals and asset owners came to greet him at the cocktail reception and dinner. Positive comments and praises for his moderation approach and speeches. As Prof. Louis Cheng was the only academic invited to give speeches at the event, the ESG Centre at HSUHK has definitely strengthened its reputation in the hedge fund industry as the leading knowledge transfer unit for ESG research among universities in Hong Kong.

Pension Bridge Alternatives APAC Hong Kong 2023 was held by With Intelligence, at the Hong Kong Harbour View Hotel from September 26 to 27, which attracted investment professionals from various industries to participate in the two-day event.

Asia Sustainability and ESG Summit 2023 Held in Bangkok (Aug 19, 2023)

The Research Centre for ESG (CESG) of the Hang Seng University of Hong Kong (HSUHK), and the Graduate School of Management and Innovation (GMI) of King Mongkut’s University of Technology Thonburi (KMUTT) in Thailand co-organized Asia Sustainability and ESG Summit 2023 on August 17-19 at the KMUTT Knowledge Exchange for Innovation Center (KX) in Bangkok, bringing together over 40 academic and industry professionals to share findings and insights on ESG integration and business sustainability.

In the afternoon of August 17, Dr. Tientip Subhanij, Chief of Investment and Enterprise Development, Trade, Investment, and Innovation Division, UNESCAP, Dr. Allinnettes Adigue, Head of GRI ASEAN Regional Hub, and Prof. Louis Cheng, Dr. S H Ho Professor of Banking and Finance, Director of Research Centre for ESG, the Hang Seng University of Hong Kong, delivered opening remarks and shared their insightful comments on SDG implementation in Asia and ESG reporting. The speeches were followed by a networking session with refreshment.

The second day (August 18) of the Summit began with the welcoming address by Dr. Suvit Saetia, the KMUTT President, illustrating in detail how KMUTT engaged the society through environmental and social solutions. Prof. Simon Ho, the HSUHK President, demonstrated his innovative and impressive thoughts on developing ESG practices through a video broadcast. Dr. Vorapoch Angkasith, the GMI Dean, KMUTT, discussed how his school supports ESG in various activities including the ESG Summit. Then, Prof. Bradley Barnes, Business School Dean, HSUHK, showcased various examples of ESG related projects under the centres and units within the school.

For the keynote speech, the speaker gave an insightful presentation, combining his own practical experience and explaining how to integrate ESG in asset management from the perspective of “Dual Materiality”.

For the afternoon session, well-known scholars such as Prof. John Goodell, Editor-in-Chief of Research in International Business and Finance (RIBAF), University of Akron, and Prof. C.S. Agnes Cheng, Professor of Accounting, University of Oklahoma, presented their latest research on ESG disclosure in the afternoon session. Dr. Liane Lee from the Hang Seng University of Hong Kong and Ms. Vivi Hu, CEO of YoujiVest, discussed big data analytics and machine learning for ESG research during the panel discussion. Their presentations opened the minds of the participants in terms of using AI solutions to explore ESG performance of listed firms.

For the concurrent sessions, a wide range of ESG hot topics, including ESG disclosure and information asymmetry in accounting, ESG integration in finance, and ESG issues in the real estate sector were discussed. The sessions were chaired by Prof. C.S. Agnes Cheng, Dr. Jeff Shen, and Prof. Piyush Sharma. In short, the presentations reflected that a growing number of professors and business professionals regard ESG issues as important topics for academic research and industry practices.

The ESG Summit came to an end successfully. The next year’s ESG Summit will be held in Shenzhen, China in May 2024 tentatively. Please stay tuned for more information about the arrangements for the next ESG Summit.

ITF Seminar 1 Is Successfully Held (Aug, 2023)

The ITF Seminar 1 is successfully held on Aug 14, 2023. Physical and online participants benefited a lot from the seminar.

The first half of Seminar 1 introduces basic knowledge of ESG intelligence data. Starting with UN SDG Goal 13 (climate action), Dr. Liane Lee introduces the relationship between ESG data and corporate performance. Vivi Hu, the CEO of YoujiVest, explains ESG sentiment data was generated by labeling the key words in the language models.

The second half of the Seminar focuses on the initial features of the ESG intelligence dataset. Prof. Louis Cheng demonstrates the interpretations of the ESG data from different eye views by Python 3D visualization. Dr. Jianfu Shen introduces ESG disagreement and demonstrated the application of ESG intelligence data in the research field.

Disclaimer: Any opinions, findings, conclusions or recommendations expressed in this material/event (or by members of the project team) do not reflect the views of the Government of the Hong Kong Special Administrative Region, the Innovation and Technology Commission or the Vetting Committee of the General Support Programme of the Innovation and Technology Fund.

Prof. Louis Cheng as the Chairman of HKIRA Investor Relations Awards (June , 2023)

As the Chairman of HKIRA Investor Relations Awards, Hong Kong Investor Relations Association, Prof. Louis Cheng announces the winners of the 9th Hong Kong Investor Relations Awards (IR Awards) in 2023 for recognizing Hong Kong listed companies and IR professionals for their outstanding performance and best practices in investor relations. The other presenters of IR Awards give out awards to companies including Mr. Joseph Chan, Under Secretary for Financial Services and the Treasury and some senior executives.

Click here to read the full article.

Prof. Louis Cheng: Master Insight’s ESG Award is the most prestigious ESG award in Hong Kong (June, 2023)

Master Insight’s 5th Financial Summit and the ESG Award 2023 is held on June 12 in Grand Hyatt Hotel with a total of 16 companies and organizations were awarded the Enterprise Awards (灼見名家ESG企業大獎) this year and Dr. MA Jun, the Chairman and the President of HKGFA received the Master Insight’s ESG Award of Excellence (灼見名家ESG翹楚大獎).

Prof. Louis Cheng, the Chairman of the ESG Award Judging Panel, says Master Insight’s ESG Award is the most prestigious ESG award in Hong Kong due to its rigorous judging process.

Dr. MA points out green finance is in the ascendant with many development opportunities. The event is recorded and broadcasted by Phoenix Television in mainland China. Over 680,000 viewers watched the program.

Click here to read the full article.

News related to The University Elite ESG Challenge 2023

The Hang Seng x Value Partners University Elite ESG Challenge Is Successfully Concluded (May, 2023)

The ESG Challenge celebration dinner is held at the Hang Seng Bank office on May 10. Over 40 students and professionals attended the celebration dinner. Rosita Lee, CEO of Hang Seng Investment Management and Prof. Louis Cheng share their thoughts with the participants, which included many senior executives supporting the Challenge. The celebration dinner marks the end of the ESG Challenge. We thank all our sponsors, judges and participants for joining the Hang Seng x Value Partners University Elite ESG Challenge.

The Winners of the Hang Seng x Value Partners University Elite ESG Challenge 2023 is Born!

The 7-month long University ESG Challenge 2023 has come to successful completion on 25th March when the Final-8 teams from HKUST, HKU, CUHK, PolyU, CityU, and HSUHK made their final presentations at the Value Partners Headquarters in Central. The Final-8 demonstrated their understanding of ESG, which gained from the competition, and competed for the championship. Each team consisted of three university students studying in Hong Kong. All teams were from single universities, except for one mixed university team. Their majors are Finance, Accounting, Politics and Public Administration, Corporate Governance, etc.

In March, representatives from Big 4 coached the Final-8 students in analysing ESG reports. Later, the Final-8 submitted a 20-min video and report to assess the ESG performance of two Hong Kong companies. Their works were evaluated in detail by the judges before the competition. Therefore, the day of the competition was mainly a Q&A session which was the last opportunity for the teams to strive for better performances.

The seven-member judging panel was chaired by Professor Louis Cheng of HSUHK. The representative of Hang Seng Bank was Ms. Rosita Lee, Director and Chief Executive Officer, Hang Seng Investment Management Limited. The representative of Value Partners was. Mr. Vincent Ching, Head of Intermediaries, Asia Pacific, Value Partners. The remaining judges were the partners of Big 4.

The Final-8 teams performed very well, fully demonstrating their understanding of ESG. After a fierce competition, the champion is born.

The mixed team of HSUHK, HKUST and HKU won the championship; HKUST won the first runner-up; CUHK won the third runner-up. In addition to internships and job opportunities at Hang Seng Bank, Value Partners and Big 4, the top three winners received HK$30,000, HK$15,000 and HK$9000. The teams that won merit awards also received HK$3000. The winner stood out from 47 teams that truly deserved it.

The organiser hoped all participating students became ESG elites through ESG training in this Challenge. So, all 37 teams who completed the competition could contribute to Hong Kong’s environmental and social responsibility work, regardless of whether they won a prize.

Official Launch of second round (Jan 2023)

Jan 16 marked the start of second round of ESG challenge. Thank you Hang Seng Bank for providing us this wonderful venue to conduct the official launch. We are very honoured to invite representatives from Big 4 to connect with Final-8 students and coach them on analysing ESG reports, especially on the environmental and social pillars.

After the coaching sessions, students will be given one-month to conduct analysis on the sustainability performance of 1 large and 1 medium cap firms, and film a 20-mins video explaining why these firms receive their respective i-score by evaluating their ESG report. We will organize the final physical presentation, tentatively in Apr 2023, for students to recapture their findings and conduct the Q & A session with professionals.

We will be announcing the details of the final physical presentation in the next few weeks. Thank you everyone for supporting and joining our ESG Challenge.

Timeline

| Event | Date |

|---|---|

| Opening Forum | 16th Jan, 2023 |

| 2 Coaching Sessions | 1-20th Feb, 2023 |

| Case Analysis | 20th Mar, 2023 4:00pm |

| Physical Presentation | Apr 2023 |

The Final-8 is born! (Dec 2022)

After a sequence of intensive ESG trainings including workshops, online training, and trading simulation, the Final-8 is officially born! They are, in the sequence of ID:

| UST(S)005 | UST(S)012 | UST(S)013 | HSU(M)005 |

| HSU(S)008 | City(S)003 | CUHK(S)007 | UST(S)018 |

| UST(S)005 | UST(S)012 | UST(S)013 |

| HSU(M)005 | HSU(S)008 | City(S)003 |

| CUHK(S)007 | UST(S)018 |

Congratulations to the Final-8!

Even if you are not in the Final 8, you can still join our internship bidding as long as you have completed our round 1 ESG Challenge (i.e. completed both online ESG training and the trading simulation.) We will be announcing the details of internship bidding in the next few days.

We thank everyone for joining and supporting our ESG Challenge, we hope you had a fruitful ESG learning journey. Merry Christmas.

Congratulations to the Final-8!

Even if you are not in the Final 8, you can still join our internship bidding as long as you have completed our round 1 ESG Challenge (i.e. completed both online ESG training and the trading simulation.) We will be announcing the details of internship bidding in the next few days.

We thank everyone for joining and supporting our ESG Challenge, we hope you had a fruitful ESG learning journey. Merry Christmas.

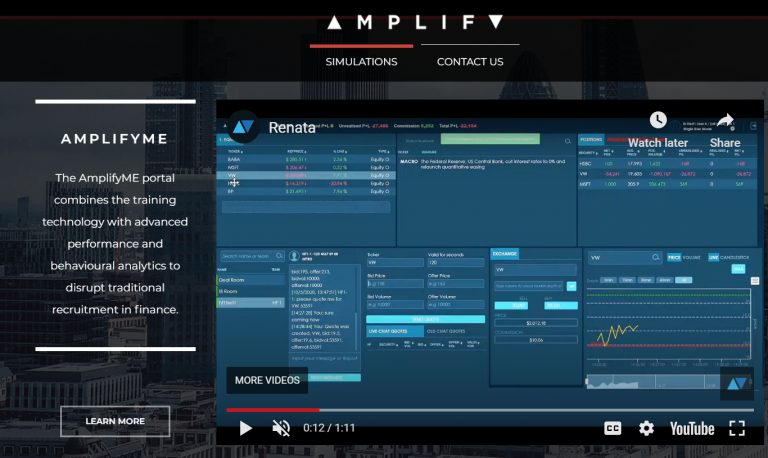

Trading simulation (Nov 2022)

This ESG trading simulation helped candidates gain their first practical insight into different roles in the finance industry. Performance metrics are automatically created for both investment banks sales and trading, and asset management, helping guide candidates to what path in finance may be most suitable for them. Furthermore, the session helped participants gain a practical understanding of how ESG news impacts asset prices. 37 teams attended the trading simulation.

Unlike most investment games which depend on total profit generation as the single measure to determine winners, the simulation evaluation mechanism captured trading and behavioral statistics during the simulation competition. The platform provides 10 performance metrics (6 for sell side and 4 for buy side) in order to determine the winners of the simulation.

Online ESG Training (Nov 2022)

Collaborating with IFPHK as our Strategic Online Training Partner, we successfully launched an online ESG training course for the participants. A total of 104 students (from 41 teams) completed the online ESG training.

There are two learning modules. M1: From CSR to ESG: The journey to sustainability, and M3: ESG integration. Each module is separated into a learning video and an MCQ assessment. Students first watched the M1 video, which contains 3 sections. Then, they completed the M1 assessment, which contains 3 MCQs. The M1 video is 12 minutes long. Students can attempt the M1 MCQ 3 times, and getting 2 correct questions out of 3 are considered to have passed the assessment. After completing M1 module, students continued to M3 module, where they watched the M3 learning video, and answered 3 MCQ also. The M3 video is 20 minutes long. Students will also have 3 chances to answer the M3 MCQ, and the passing mechanism is the same. Watching all learning videos and answering all questions means the students have completed the online ESG training.

University Elite ESG Challenge 2023 Launch Forum (Oct 2022)

A total of 47 teams of students from nine universities in Hong Kong is expected to join this Launch Forum. Mr. Joseph Chan, Under Secretary for Financial Services and the Treasury, Ms. Rosita Lee, Director and CEO of Hang Seng Investment Management, Ms. June Wong, CEO of Value Partners, and many senior executives from the finance and accounting industries will share their wisdom and experience with the Challenge participants.

We would like to thank Department of Finance of CUHK for being the venue sponsor.

University Elite ESG Challenge 2023 Launch Forum (Oct 2022)

A total of 47 teams of students from nine universities in Hong Kong is expected to join this Launch Forum. Mr. Joseph Chan, Under Secretary for Financial Services and the Treasury, Ms. Rosita Lee, Director and CEO of Hang Seng Investment Management, Ms. June Wong, CEO of Value Partners, and many senior executives from the finance and accounting industries will share their wisdom and experience with the Challenge participants.

We would like to thank Department of Finance of CUHK for being the venue sponsor.

Workshop: "Learning how to communicate effectively through social media and online platform" (Oct 2022)

In this workshop, we are proud to have 3 dynamic speakers to share their wisdom and expertise to student representatives of our approved 47 teams from UST, CUHK, HSU, HKU, CityU, PolyU, HKBU, and LingU.

For more details, please refer to the poster.

Workshop: "Learning how to communicate effectively through social media and online platform" (Oct 2022)

In this workshop, we are proud to have 3 dynamic speakers to share their wisdom and expertise to student representatives of our approved 47 teams from UST, CUHK, HSU, HKU, CityU, PolyU, HKBU, and LingU.

For more details, please refer to the poster.

Registration for the ESG Challenge has completed (Sept 2022)

Due to overwhelming responses, the ESG Challenge is now closed for registration and the Challenge has officially started .

A total of 147 students from 49 teams registered for the ESG Challenge. Participating students come from eight UGC-funded universities and the Hang Seng University of HK. While the official opening is scheduled at Henry Cheng International Conference Centre, Cheng Yu Tung Building, CUHK on 29 Oct 9:30am-12:30pm, each team is already preparing their self-introduction video and will join a pre-opening training workshop on “Effective communication through social media and online platform” on 22 Oct. It will be an exciting journey for the participating students, we wish you all the best and good luck.

We would also like to thank the Department of Finance at the CUHK Business School for being the venue sponsor of the opening forum.

About the Hang Seng x Value Partners University Elite ESG Challenge 2023

Through joining this Challenge, everyone can become an “ESG Elite” through the e-learning and trading simulation provided!

The top winning team will receive a cash prize of HKD30,000. In addition to the cash prizes, all students who completed participation with satisfactory performance in the first stage can have a chance to receive internship and interview opportunities.

This ESG Challenge is open for all undergraduate university students in Hong Kong. The two Lead Sponsors are Hang Seng Bank and Value Partners. Major Academic Partners are Center for Investing, Finance Department, HKUST and Centre for Business Sustainability, CUHK. In addition, the Big4 (Deloitte, KPMG, EY, and PwC) are Strategic Professional Partners which will provide ESG report coaching to the finalists.

To know more about the Challenge, please visit our website at https://info4925468.wixsite.com/std-esg-competition

The Centre provides technical support for Master Insight's ESG Award 2023

Master Insight will organize the 5th Financial Summit together with the ESG Award 2023 on 12th June in Grand Hyatt Hotel.

The ESG Award aims at recognizing films with outstanding ESG performance, and their contribution in promoting ESG development.

We are glad to be invited, and provide support for the event. Prof. Louis Cheng will be the chairman of the judging panel.

For more details of the event, please visit: http://bitly.ws/Bx3

Prof. Louis Cheng shares his views with Master Insight on the growing importance of ESG in Hong Kong and future direction of green finance

(Mar, 2023)

(Mar, 2023)

In an interview with Master Insight, Prof. Louis Cheng talked about ESG integration, role of different stakeholders in ESG, how carbon credit promote ESG, and the future direction of ESG.

Click on the link below to read the full article:

Press Release: The Official Fintech Penetration Survey Report

(Dec, 2022)

English Version:

After a year of research and analysis, the Research Centre for ESG at HSUHK released the full version of the Fintech Penetration Survey Report. The S. H. Ho Foundation (何善衡慈善基金會) funded Prof. Louis Cheng to conduct a project called “Overcoming Challenges of Banking Services for the Next Decade: Sustainable Lending and Digital Banking”. This is the first output of the project. In July 2022, some findings of the project were presented at the Fintech X ESG Symposium, which was also funded by The S. H. Ho Foundation.

The objective of the project is to find out, under Covid-19, how bank customers in Hong Kong view the financial services provided by traditional banks (both physical and online services), virtual banks, and online investment platforms. This report is prepared to provide an extensive examination of how demographic characteristics such as gender, age, and wealth level may affect customers’ behaviours in choosing financial services.

The Report discovered that regardless of gender, age, and personal wealth level, customers seem to be more satisfied with the services provided by online investment platforms, leading to a stronger commitment and trust with their services. As to explain why virtual banks and traditional banks are less preferred by customers, it is suggested that the intangible and technological nature of virtual banks could be a barrier for the older generation. Hence, virtual banks can consider tailor-making their service platforms to be more user-friendly to win over the older customers. It is also conjectured that due to Covid-19 and the emerging technology trend among young customers, customers expect a higher level of interactions in digital financial services. Hence, traditional banks could consider enhancing their online services. This is especially important as the Report found that online services of traditional banks captured a high rating (in absolute sense) for usage during Covid-19, and the pattern of migrating to online services will be permanent even when physical banking resumes.

Click here to read the full report.

中文版:

經過一年的調查與研究分析,恒大ESG研究中心正式在二零二二年十二月發布了金融科技滲透率調查報告的完整版本。鄭子云教授獲何善衡慈善基金會資助,進行名為「克服銀行服務未來十年面對的挑戰:可持續借貸和數碼理財」的研究項目。這報告是該項目的首個成果。在二零二二年七月,鄭子云教授在Fintech X ESG研討會分享了金融科技滲透率調查的初步研究結果。該研討會亦獲何善衡慈善基金會資助。

項目旨在研究在新冠疫情期間,香港各銀行的顧客如何看待由傳統銀行(實體和網上服務)、虛擬銀行、和網上投資平台提供的金融服務。這份報告詳細地分析了不同的人口區隔分類,如性別、年齡和財富水平如何影響顧客選用金融服務。

報告發現,無論以性別、年齡或個人財富水平分類,結果均顯示顧客較爲滿意網上投資平台提供的服務,因此顧客對其忠誠和信任程度亦較高。虛擬銀行並沒有實體分行,而是透過網絡提供服務。這可能是導致年長一輩卻步的原因。因此,虛擬銀行可簡化其服務平台以吸引年長顧客。受新冠疫情影響,加上年輕顧客偏向使用科技化的服務,顧客會期望數碼金融服務有更多的互動。因此,傳統銀行可考慮優化其網上服務,吸引顧客使用。報告顯示在新冠疫情期間,顧客比以前更注意傳統銀行的網上理財服務。即使傳統銀行的實體服務逐步恢復正常,顧客亦會繼續使用網上服務。這再一次印證傳統銀行優化網上服務的必要性。

按此閱讀完整報告和中文精要版

Press Release: University Elite ESG Challenge - The Final-8 is born!

(15 Dec, 2022)

English version:

On 2 Dec, 2022, the first round of the ESG Challenge has come to an end. We are delighted to announce that eight top performing teams have been selected to enter the second round of the Challenge. The members of these eight teams come from UST, CUHK, HKU, CityU, and HSU. All 47 teams have gone through a series of activities and training organized by the HSU Research Centre for ESG (CESG) in round 1.

Activity 1: Communication workshop

The ESG Challenge held its first physical event on 22 Oct, which is a workshop on “Effective communication through social media and online platform”. We invited 3 dynamic speakers including Mr. Vivek Mahbubani, a famous standup comedian and YouTuber, to share their wisdom and expertise to student representatives from 47 teams. They talked about the use of color scheme in presentations, building a personal brand, and ways to conduct an eye-catching presentation, which is greatly beneficial to students as they can learn and improve their presentation skills.

Activity 2: Launch Forum and coffee chat with executives

A Launch Forum was held on 29 Oct to mark the official start of the ESG Challenge. We were honored to invite Mr. Joseph Chan, the Under Secretary for Financial Services and the Treasury, Ms. Rosita Lee, Director and Chief Executive Officer of Hang Seng Investment Management Limited, and Ms. June Wong, Chief Executive Officer of Value Partners Group Limited to give speeches to motivate the Challenge participants. The speeches were followed by a coffee chat session, where 10 senior executives from Big 4, investment banks, commercial banks, asset management, and CFAI gave students advice and opinion on various topics.

Activity 3: Online ESG training

From early to mid-November, students started their online ESG training journey. Through accessing the online platform provided by IFPHK, students enrolled in the ESG training courses prepared by CESG. A total of 104 students from 41 teams completed the online ESG training. Two learning modules are provided, namely M1: From CSR to ESG: The journey to sustainability and M3: ESG integration. Each module is separated into a learning video and an MCQ assessment. Students first watched the M1 video, which contains 3 sections. Then, they attempt 3 M1 MCQs. Afterwards, students continued to M3 module, where they watched the M3 learning video, and answered 3 MCQ also. Students can attempt the MCQ 3 times. Watching all learning videos and answering all questions means the students have completed the online ESG training.

Activity 4: Stock trading simulation competition

Lastly, students from 37 teams participated in the trading simulation competition on 19 Nov as a final test for their performance. This ESG trading simulation helped candidates gain insights into different roles in the finance industry and understanding of how ESG news impacts asset prices. Unlike most investment games which depend on total profit generation as the single measure to determine winners, the simulation evaluation mechanism captured trading and behavioral statistics during the simulation competition. Students were evaluated by many aspects including Commission, Fat Finger Count, No. of Client Trades, Risk Management, Exchange impact, Profit & Loss (sell-side), and Return on Investment, Risk Appetite, Buy-side risk management, Execution Score (buy-side).

Then, a weighted evaluation scheme to combine all 4 activities was employed to generate the final ranking. The evaluation committee comprises of representative from CESG, VP, and HSB to confirm the Final 8 teams for the second round. In early next year, we will announce the launch of the second round of the Challenge and brief the Final 8 teams. Afterwards, the teams will start to prepare for their final evaluation and they will receive coaching from Big4 executives on ESG report analysis. Lastly, between late March to early April, teams will do a presentation to showcase what they have learnt.

We hope our activities helped students become ESG Elites. Please stay tuned to the second round of the competition.

中文版:

恒生x惠理學界精英ESG挑戰2023的第一輪在二零二二年十二月二日正式完結。我們很高興宣佈選出了八隊隊伍進入比賽的終極挑戰。這些隊伍的隊員分別來自香港科技大學、香港中文大學、香港大學、香港城市大學和香港恒生大學。在挑戰的第一輪,四十七隊隊伍參加了一系列由恒大ESG研究中心舉辦的活動和培訓。

活動一:溝通技巧工作坊

ESG挑戰的首個活動是十月二十二日舉行的社交媒體營銷工作坊。我們邀請了三位講者向四十七隊隊伍代表分享他們的經驗之談,其中包括著名楝篤笑表演者及YouTube網紅Vivek Mahbubani先生(阿V)。三位講者分享了如何使用色彩提升報告的可讀性、如何建立個人品牌、和如何在報告時吸引觀眾的注意。這些技巧對學生在進行挑戰的最終報告或平日上課時都非常有用。

活動二:啟動典禮和互動座談會

我們在十月二十九日舉行了啟動典禮,這標誌著ESG挑戰正式開始。我們有幸邀得香港特別行政區政府財經事務及庫務局副局長陳浩濂先生太平紳士、恒生投資管理有限公司董事兼行政總裁李珮珊女士、和惠理集團有限公司行政總裁黃慧敏女士致辭,鼓勵參加挑戰的學生。在隨後的互動座談會,十位來自四大會計師事務所、投資銀行、商業銀行、資產管理公司和CFA協會的企業高管向參賽者分享他們的見解和經驗。

活動三:網上ESG培訓

在十一月中上旬,透過香港財務策劃師學會提供的平台,同學參加了由ESG研究中心準備的網上ESG課程,共有一百零四名來自四十一隊的學生完成了培訓。我們為學生提供兩個學習單元,分別是單元一:由企業社會責任到環境社會和企業管治:一趟達至可持續性的旅程,和單元三:ESG整合。每個單元可分為一條培訓短片和選擇題測驗。同學首先觀看單元一短片,然後回答三條有關單元一的選擇題。之後同學觀看單元三短片,回答三條有關單元三的選擇題。同學可作答每單元的測驗三次。觀看所有培訓短片和回答所有測驗意味著同學完成了網上ESG培訓。

活動四:模擬股票交易比賽

最後,在十一月十九日,三十七隊參與了模擬交易比賽。這是選出八強隊伍前的最後一個測驗。這個模擬交易幫助學生了解金融行業裡的不同角色,和ESG新聞如何影響資產定價。相比起其他以總利潤決定輸贏的投資遊戲,我們的模擬交易比賽記錄了學生在玩遊戲時的交易數據和行爲數據。我們從十方面評估學生的表現,包括佣金、胖手指失誤、客戶交易數量、風險管理、匯率差價及損益數據(賣方指標),和投資回報率、風險偏好、買方風險管理及執行效率(買方指標)。

在所有活動完結後,我們按每個活動佔的比重計算出最後各隊的分數。來自ESG研究中心、惠理集團和恒生銀行的代表組成評審委員會決定八強名單。

終極挑戰:

進入終極挑戰後,我們會在明年初啓動第二輪比賽,向八強隊伍講解比賽的終極挑戰。學生隨後會接受四大會計師事務所的指導,學習如何分析ESG報告。最後,八強隊伍會在三月末至四月初進行匯報,展示他們的學習成果。

我們希望這些活動能幫助同學成爲ESG精英。比賽的終極挑戰即將開始,請大家密切留意。

Press Release: University Elite ESG Challenge - The Final-8 is born! (15 Dec, 2022)

English version:

On 2 Dec, 2022, the first round of the ESG Challenge has come to an end. We are delighted to announce that eight top performing teams have been selected to enter the second round of the Challenge. The members of these eight teams come from UST, CUHK, HKU, CityU, and HSU. All 47 teams have gone through a series of activities and training organized by the HSU Research Centre for ESG (CESG) in round 1.

Activity 1: Communication workshop

The ESG Challenge held its first physical event on 22 Oct, which is a workshop on “Effective communication through social media and online platform”. We invited 3 dynamic speakers including Mr. Vivek Mahbubani, a famous standup comedian and YouTuber, to share their wisdom and expertise to student representatives from 47 teams. They talked about the use of color scheme in presentations, building a personal brand, and ways to conduct an eye-catching presentation, which is greatly beneficial to students as they can learn and improve their presentation skills.

Activity 2: Launch Forum and coffee chat with executives

A Launch Forum was held on 29 Oct to mark the official start of the ESG Challenge. We were honored to invite Mr. Joseph Chan, the Under Secretary for Financial Services and the Treasury, Ms. Rosita Lee, Director and Chief Executive Officer of Hang Seng Investment Management Limited, and Ms. June Wong, Chief Executive Officer of Value Partners Group Limited to give speeches to motivate the Challenge participants. The speeches were followed by a coffee chat session, where 10 senior executives from Big 4, investment banks, commercial banks, asset management, and CFAI gave students advice and opinion on various topics.

Activity 3: Online ESG training