ESG Intelligence

This project is based on research funded by an RGC IDS Grant titled “Establishing a Research Infrastructure for ESG Intelligence: A Multi-Stakeholder Perspective” (RGC Ref. No.: UGC/IDS(R)14/21). We recognize the importance of measuring ESG efforts and performance from stakeholders’ perspectives. The objective of this project is to provide a clear road map with a scientific methodology to demonstrate how the stakeholders of the four Research Components (RCs) can use a tailor-made ESG intelligence through our research findings from the IDS project. Our goal is to create an alternative data for listed firms to support an efficient business decision for the stakeholders.

IDS Final Outcome and Methodology Report (June 2025)

Important Reminder:

This material should be used only as a reference in understanding the subject matter. It is not an offer to sell or solicitation for an offer to buy any financial products and services and they should not be considered as investment advice. The parties involved in preparing the content of this presentation material are not liable financially in any way as a result of using information documented by any individuals or corporations. The Research Centre for ESG, The Research Grants Council, Prof. Louis Cheng and the research team involved accept no responsibility or liability for the accuracy and completeness of such information in the material.

IDS Final Report (June 2025)

The following information is arranged by chronological order of the events and announcements.

ESG Intelligence: Theory and Practice Conference

(Half-Day Event in Admiralty)

Date: 19 May (Mon), 2025

Time: 2:00 – 5:00 PM

Venue: Chatham Room, Conrad Hong Kong, Level 7, Pacific Place, 88 Queensway, Hong Kong

Funded by the IDS grant from the RGC, the Research Centre for ESG of The Hang Seng University of Hong Kong (HSUHK) successfully hosted its “ESG Intelligence: Theory and Practice” conference at Conrad hotel on May 19, 2025. The event drew over 70 financial leaders, policymakers, scholars, and sustainability experts to explore actionable strategies for environmental, social, and governance challenges. Professor Joshua Mok Ka-ho, Provost and Vice-President (Academic & Research) of HSUHK delivered a keynote address titled “Social Entrepreneurship: Policy and Practices in Hong Kong”, mapping the government’s strategic shift in social innovation.

Additionally, Professor Louis Cheng, Director of the Research Centre for ESG and Associate Dean (Research) of School of Business gave a featured presentation to summarized the research finding of the RGC project titled “Establishing a Research Infrastructure for ESG Intelligence: A Multi-Stakeholder Perspective” (RGC Ref. No.: UGC/IDS(R)14/21). The session highlighted four stakeholder perspectives on ESG data intelligence: investors, accounting, consumers, and corporate communications. Then, a panel of experts further elaborated the research insight and industry applications of the topics. To read the complete report of the IDS research, please visit the ESG Centre website at https://esg.hsu.edu.hk/esg-intelligence/#ids-final-report.

During the conference, Ms. Vivi Hu, CEO of YoujiVest, demonstrated how AI is revolutionizing the business applications and investment strategies using big data related to climate change and ESG. Besides, a fireside chat moderated by Prof. Louis Cheng featuring Dr. Jacky Tang, Chief Investment Officer of an international asset management firm, and Dr. Ricky Szeto of Social Welfare Advisory Committee tackled the issue of balancing between financial return and societal impact. Participants and speakers engaged in an active dialogue throughout the conference.

For more information on the event, please click here.

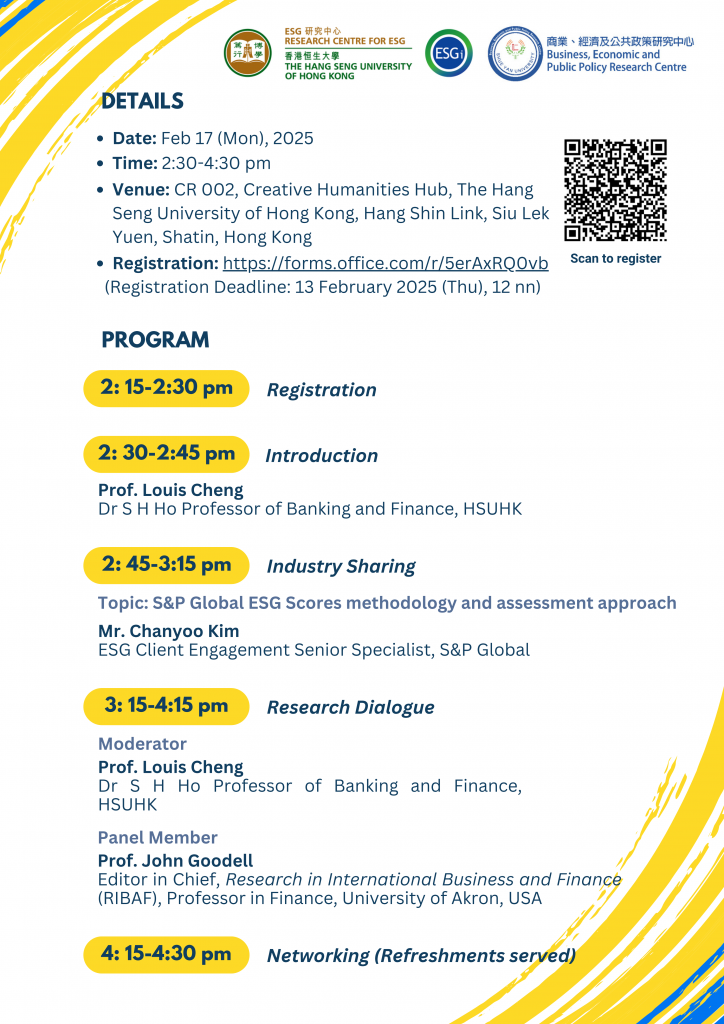

ESG in Focus: HSU-SYU Seminar – ESG x Internationalization

(Half-Day Event on Campus)

Date: February 17, 2025 (Monday)

Time: 2:30 – 4:30 PM

Venue: CR 002, G/F, Creative Humanities Hub, The Hang Seng University of Hong Kong, Hang Shin Link, Siu Lek Yuen, Shatin, Hong Kong

The Research Centre for ESG organized an ESG seminar at HSU campus on Feb 17, 2025, attracting about 30 academics from multiple universities and colleges to join.

At the seminar, Mr. Chanyoo Kim, ESG Client Engagement Senior Specialist from S&P Global, introduced S&P Global ESG Scores and interacted with the audience actively, sharing sustainability development from an industrial perspective.

In the next session, Prof. John Goodell, Editor in Chief, Research in International Business and Finance, (RIBAF), Professor in Finance, University of Akron, USA, had a research dialogue with the moderator, Prof. Louis Cheng, going through the suggested topics of the RIBAF Special Issue: Business Sustainability and ESG Integration: An International Business Perspective. The Guest Editors of the Special Issue, Prof. Ricky Chan and Prof. Walid Saffar, also engaged in the conversation. The insightful sharing was well-received by the audience.

For more information on the event, please click here.

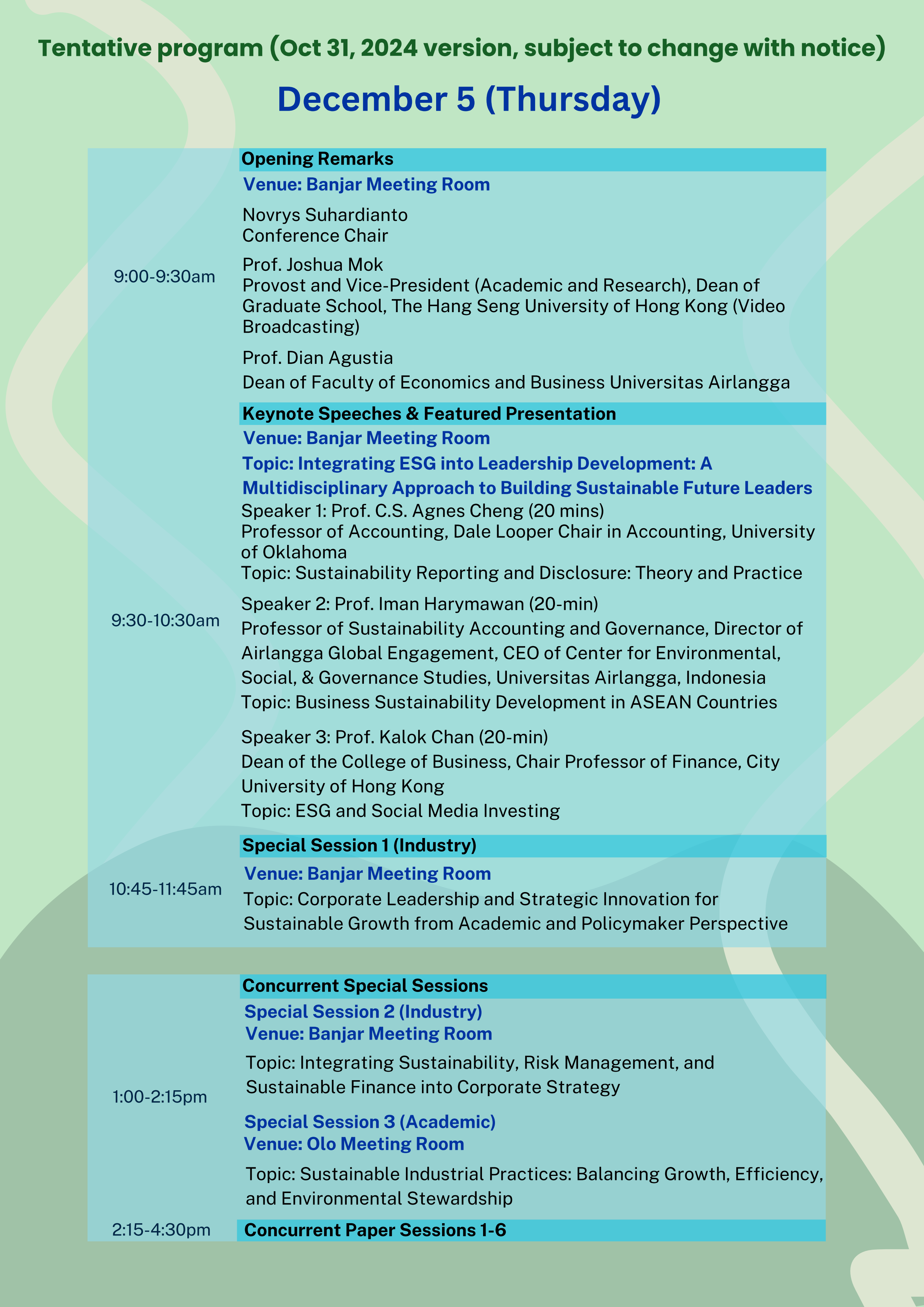

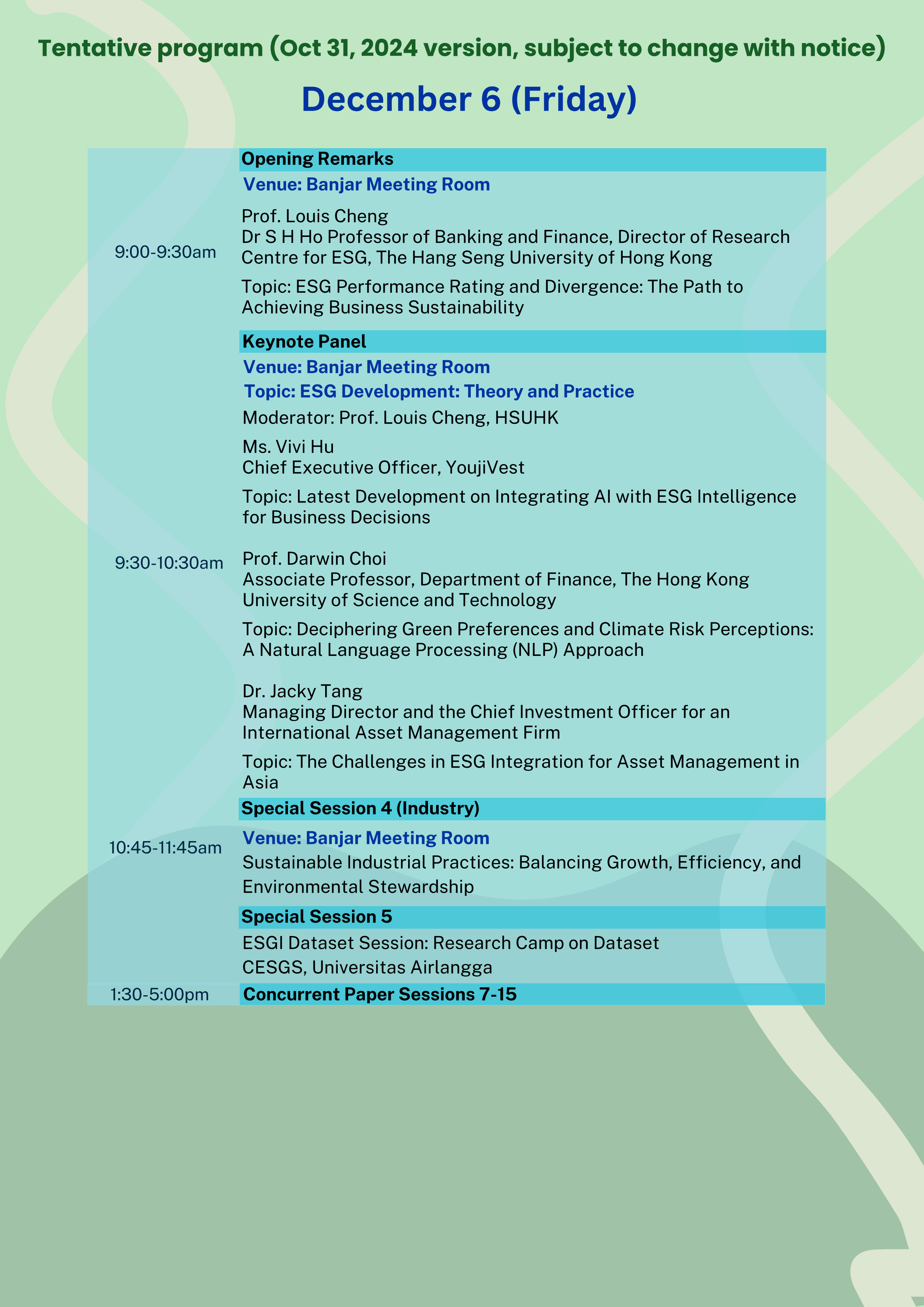

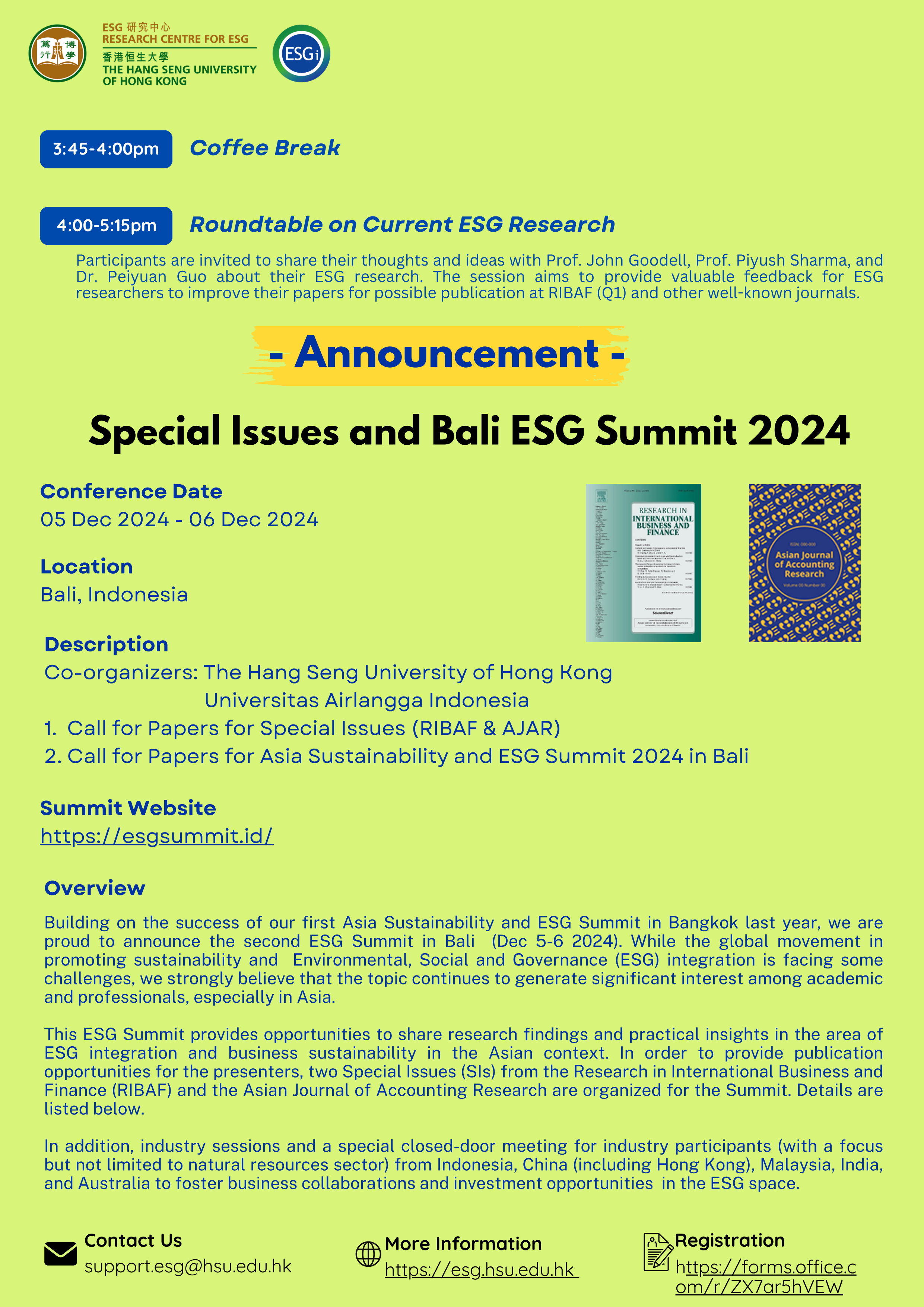

2nd Asia Sustainability and ESG Summit 2024

(2-Day Event in Bali)

Date: Dec 5-6 (Thu-Fri), 2024

Location: Bali, Indonesia

Venue: The Kuta Beach Heritage Hotel Bali

The 2nd Asia Sustainability and ESG Summit 2024 was successfully held on December 5-6 at The Kuta Beach Heritage Hotel Bali in Indonesia. 3 Best Papers Awards and 2 Emerging Scholar Awards were given and over 60 papers from 12 countries and regions were presented at the Summit. Participants from 48 universities joined in this engaging event. The Summit brought together academics, PhD students, industry executives, government officials and NGO professionals to learn about the latest ESG developments.

Please stay tuned for more information about the arrangements for the next ESG Summit. We hope to see you at the next Summit!

For more information on the event, please click here.

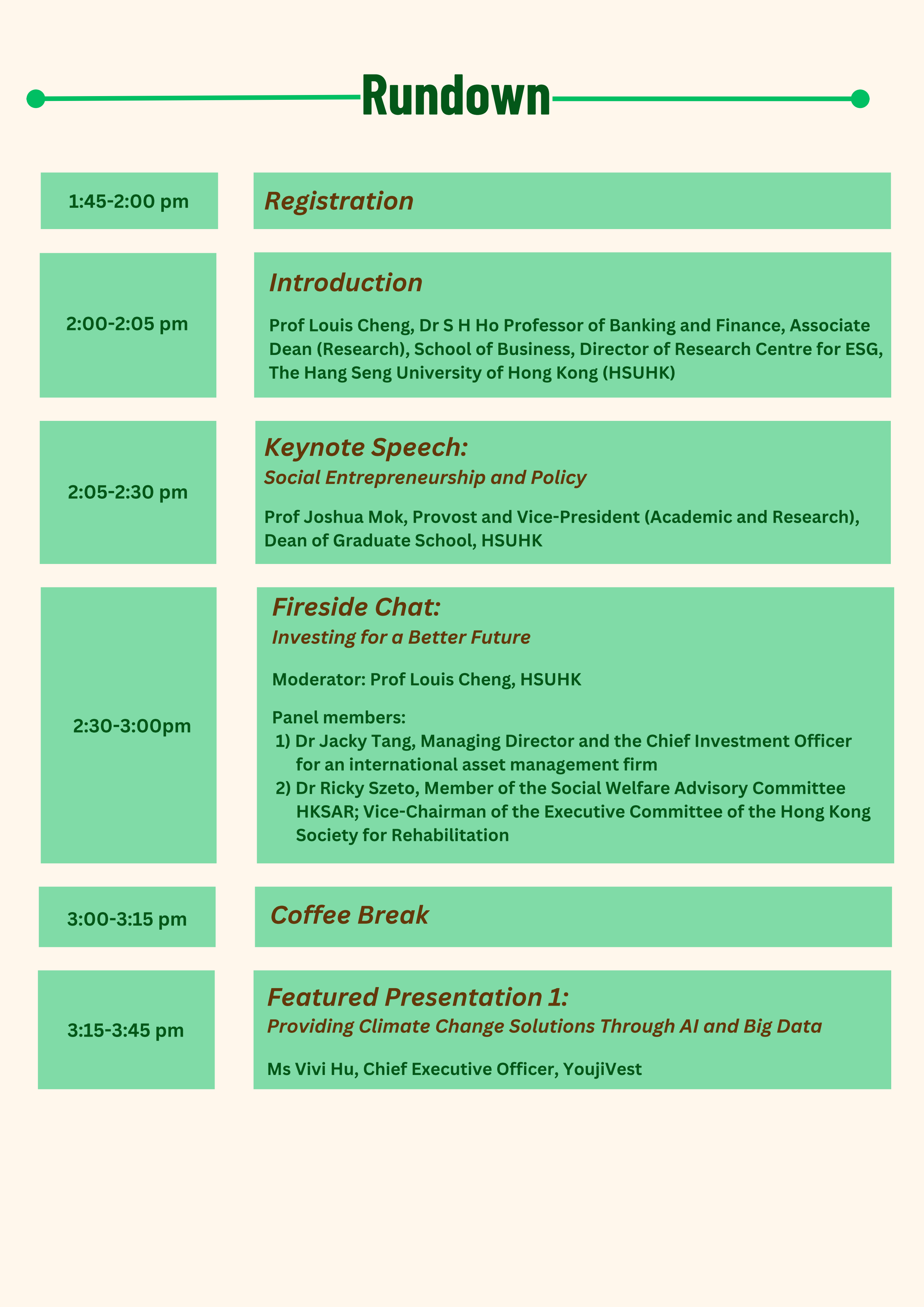

ESG Symposium - Understanding the measurements and performance of ESG integration (Half-Day Event on Campus)

Date: 6 Aug 2024 (Tue)

Time: 1:45 – 5:15 PM

Venue: D801, Lee Ping Yuen Chamber, 8/F, Lee Quo Wei Academic Building, Yuen Campus, The Hang Seng University of Hong Kong, Hang Shin Link, Siu Lek Yuen, Shatin, Hong Kong

The Research Centre for ESG (CESG) organized an ESG symposium entitled “Understanding the measurements and performance of ESG integration” on Aug 6, 2024 at the HSUHK campus under the IDS project (UGC/IDS(R)14/21). 55 participants, including academics, industry executives, and civil servants attended the symposium.

Prof. John Goodell, Editor in Chief, Research in International Business and Finance (RIBAF), and Professor in Finance, University of Akron, USA, gave an impressive keynote speech on the title “Is ESG non-pecuniary? Reacting to the lawsuit of 25 attorneys general” and provided valuable insight in publishing ESG research in Q1 journals such as RIBAF.

Next, Prof. Louis Cheng hosted a fireside chat for Prof. Piyush Sharma, John Curtin Distinguished Professor and Professor of Marketing, Curtin University, Australia and Dr. Peiyuan Guo, Chairman of SynTao Green Finance. After Prof. Cheng introduced what is i-score and how to use i-score to measure ESG performance, the two speakers shared their views on integrating ESG Data into business research.

As for the next panel discussion, the moderator, Dr. Jerry Cao, Associate Professor of Finance, HSUHK, interacted proactively with representatives from well-known ESG data vendors. Ms. Liz Campbell, Client Relations, APAC, Morningstar Sustainalytics, Ms. Vivi Hu, CEO, YoujiVest, and Dr. Peiyuan Guo served as the panelists to report the latest development in ESG and climate data from the perspective of data providers and rating agencies.

Finally, academics were invited to participate in a roundtable discussion to share their questions and thoughts with Prof. John Goodell, Prof. Piyush Sharma, Dr. Peiyuan Guo, and Ms. Vivi Hu about their ESG research. The session provided valuable feedback for ESG researchers to improve their papers for possible publication.

For more information on the event, please click here.

Sustainability Leadership Symposium

(Whole-Day Event in Central)

Date: 9 January 2024 (Tue)

Time: 9:30am-12:15pm

Venue: Rooms 1101-02, 11/F, Excellent Global Business Centre, Euro Trade Centre, 13-14 Connaught Road, Central

Prof. Simon S.M. Ho, President of HSUHK, developed a stakeholder-based “Responsible Management” conceptual framework which focuses on three fundamental components, namely Stakeholders, Ethics and Sustainable Values.

Led by Prof. Louis Cheng, The Research Centre for ESG (CESG) of The Hang Seng University of Hong Kong (HSUHK) held the Sustainability Leadership Symposium to discuss how sustainability leadership is being practiced in the business world with a focus on stakeholders’ perspective on Jan 9, 2024, in Central, bringing around 70 academic and industry professionals to attend the morning forum.

In addition to the keynote speech by the President on the topic “The Objective of a Corporation: Optimising Sustainable Values for Different Stakeholders”, two discussion panels on ESG Leadership, one on financial services and the other on NGOs were arranged. Many participants including academics from other universities and industry leaders actively engaged in discussions with the speakers. The overall evaluation from the participants is very satisfactory, achieving an evaluation rating of about 9 points out of 10.

For the afternoon closed-door Roundtable, senior representatives from ten organisations including Securities and Futures Commission, Hong Kong Institute of Certified Public Accountants, Hong Kong Chartered Governance Institute, CFA Society Hong Kong, The Hong Kong Institute of Bankers, Hong Kong Securities and Investment Institute, UN ESCAP Sustainable Business Network and others joined the meeting to discuss the role of stakeholders in ESG practice in Hong Kong.

After Prof. Ho introduced the background and discussion items of the meeting, the participants exchanged their opinions proactively. The meeting lasted for over two hours with active discussion on the topic. Key conclusions can be summarized as below:

● The participants recognized that investors are the single major stakeholder in the Hong Kong market among all stakeholders. ESG has been taken seriously since the HKEx mandated companies to disclose and it is established mainly from the perspective and needs of investors. Additionally, the purpose of being a listed company is to raise funds from investors. Investors will remain the primary focus of ESG reporting.

● It is important to consider a multi-stakeholder perspective in ESG reporting, but it should not be mandatory. Different stakeholders may have conflicting value perspectives. It would be difficult for the company to balance multi-stakeholders’ requests as there is no easy framework to solve the existing problems.

● It is agreed that ESG reporting is crucial for listed companies. Investors invest in the company’s future rather than past performance. While financial reports reveal the current performance of a company, ESG reports provide a forward-looking perspective on the company’s prospects.

● Education should play a more significant role in persuading the Board to pursue ESG cost-effectively with impacts. The Board holds a leadership role in ESG reporting since they determine the materiality assessment. It is important for the Board to identify and implement its ESG strategies and evaluate the information needs of multiple stakeholders.

For more information on the event, please click here.

Understanding ESG Data for Your Research

(Whole-Day Event on Campus)

Date: July 21 (Fri), 2023

Time: 9:30am-11:45am

Venue: D801, Lee Ping Yuen Chamber, 8/F, Lee Quo Wei Academic Building, Yuen Campus, The Hang Seng University of Hong Kong Hang Shin Link, Siu Lek Yuen, Shatin, N.T., H.K

The Research Centre for ESG (CESG) and Research Institute for Business (RIB) are pleased to jointly organize a research seminar to introduce ESG data and its applications. Under the IDS funding (project #:

UGC/IDS(R)14/21), the CESG acquired ESG related data such as MSCI, SynTao Green Finance, and RavenPack, and others.

This seminar will introduce how these data can be used for research. Also, representatives from commercial data providers will introduce their data and be available for Q&A. We welcome academic and industry researchers who want to know more about ESG data and examples of how CESG employs these data to create useful ESG intelligence at firm level for further research.

For more information on the event, please click here.

Our data providers

MSCI

MSCI ESG Ratings measure a company’s management of financially relevant ESG risks and opportunities. MSCI uses a rules-based methodology to identify industry leaders and laggards according to their exposure to ESG risks and how well they manage those risks relative to peers. MSCI’s ESG Ratings range from leader (AAA, AA), average (A, BBB, BB) to laggard (B, CCC). We also rate equity and fixed income securities, loans, mutual funds, ETFs and countries.

RavenPack

RavenPack can recognize over 12 Million named entities including global companies across all industries, both public and private sectors, individuals, executives, insiders and influencers, geographic locations, products, and services. They have historical and real-time updates from sources such as Dow Jones, Wall Street Journal, Barrons, etc. Their web content captures local, regional, and national newspapers and reputable blogs and content aggregator sites. For every entity and event detected in a story, RavenPack provides advanced analytics for every entity and event detected in a story, including relevance scoring, novelty tracking, and impact analysis.

SynTao

SynTao Green Finance launched their self-developed ESG rating system in 2015, and established the first ESG database for listed companies in China. Their ESG ratings cover all listed companies in Mainland China, Hong Kong listed companies under Shanghai-Hong Kong Stock Connect and Shenzhen-Hong Kong Stock Connect, and major bond issuers. Through SynTao Green Finance’s ESG ratings data, clients can better understand the sustainability performance of portfolio companies, including their ESG management performance and ESG risks.